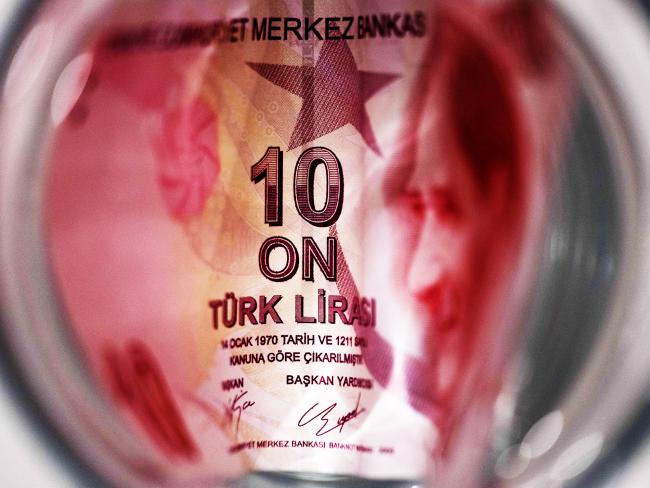

(Bloomberg) -- Turkish markets tumbled amid mounting fears that punitive measures from Washington could deal a fresh blow to the Turkish economy. The lira joined the retreat, despite efforts by state banks to support the currency.

The lira broke past the 5.92-per-dollar mark even as lenders were seen selling dollars again, according to two people familiar with the matter, who asked not to be named because because the information isn’t public. Last week, state banks sold the equivalent of at least $3.5 billion worth to support the currency, three people said.

Stocks plunged almost 3%, two-year domestic bonds yields soared as much as 66 basis points and the lira’s one-month implied yield was poised for its biggest jump since March. Room for more interest-rate cuts also appears to have vanished, with one-year cross-currency swaps trading at 16.41%, almost 300 basis points above the average cost of funding in Turkey.

The latest panic among traders comes after U.S. President Donald Trump said Washington is ready to sanction Turkey in response to its military incursion in northeast Syria, raising the prospect of another disorderly market rout. Turkey relies heavily on foreign capital inflows and is still struggling after a recession fulled by a currency crisis last year, which was partly precipitated by American sanctions.

Data published on Monday showed that industrial output fell for a 12th consecutive month in August and by more than analysts were expecting. The lira was trading at 5.9171 per dollar as of 12:27 p.m. in Istanbul, its one-month implied rate was close to 20% and the yield on two-year local-currency bonds curbed its gain to 15.77%.

Trump’s comment is the latest warning from U.S. officials this month, who have balked at the Turkish campaign against American-backed Kurdish militants. On Sunday, Treasury Secretary Steven Mnuchin said the U.S. could shut down all dollar business with Turkey. Last week, Republican Senator Lindsey Graham introduced a bipartisan bill to penalize Turkey in response to the incursion.

In a move that risks further muddying the picture, Syrian President Bashar al-Assad sent troops to the country’s northeast after Kurdish fighters turned to Damascus for support. Earlier this month, Trump ordered remaining U.S. forces in northern Syria to withdraw in the face of a rapid Turkish advance.