By Olga Cotaga

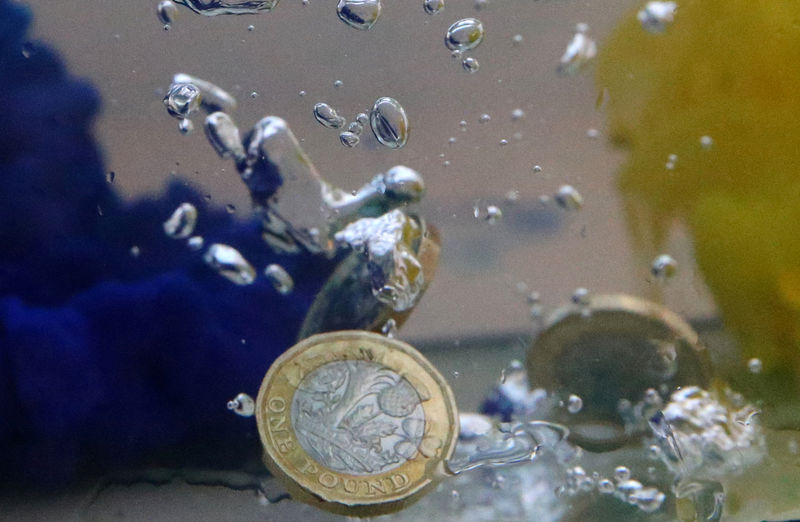

LONDON (Reuters) - After shedding nearly 10% of its value since mid-March, sterling may enjoy some calm over the remaining weeks of the British summer as traders take advantage of a parliamentary recess to unwind short positions in the currency.

Fears that Britain will leave the European Union on the Oct. 31 deadline without any transitional agreements - a no-deal Brexit - have hammered the pound in recent months. Traders have heavily shorted it - selling pounds in anticipation they can buy them back later for less.

But after the pound dropped to 10-year lows against the euro this month - not counting a mini-crash in 2016 - it has stabilized somewhat, and traders are offloading some of those shorts.

"We've been short sterling/Japanese yen for three months and we are considering to reduce (the short) now," said Vasileios Gkionakis, global head of forex strategy at Lombard Odier.

"If no-deal (Brexit) increases in probability, then of course sterling would be a sell, but until then I’m becoming a bit more neutral," Gkionakis said.

The pound has gained 0.4% and 1.6% from recent lows against the dollar and euro respectively to trade just above $1.21 and at 91.5 pence per euro (EURGBP=D3). Since the initial March Brexit deadline, it has fallen 10% against the euro and dollar and lost 15% to the yen (GBPJPY=).

Gkionakis' view seems to be shared by others: net short sterling positions were at $7.22 billion on Aug. 13, down from the previous week's $7.81 billion -- the highest since April 2017 -- according to the Commodity Futures Trading Commission.

GBP positions - https://fingfx.thomsonreuters.com/gfx/mkt/12/4910/4867/GBP%20positions.jpg

Three-month risk reversals in sterling, a contract which encapsulates the Brexit deadline, paint a similar picture. Demand for sterling "puts" -- the right to sell pounds at a pre-agreed price -- remains high. But has eased in the past week, implying investors aren't so sure sterling will drop.

The calm coincides with parliament's recess until Sept. 3. But markets also want to see whether Britain's opposition parties can agree strategies for toppling Prime Minister Boris Johnson's government or whether Johnson will persuade the EU to return to the negotiating table.

Either would see the pound rally, saddling short-sellers with losses.

"We find risk-reward more attractive to consider entering structural long sterling positions as we get closer to September," said Paul Hollingsworth, senior European economist at BNP Paribas (PA:BNPP).

HARD TO SUSTAIN

Gauges compiled by banks and asset managers also imply positioning is off recent extremes. According to RBC Capital Markets, for instance, short sterling positions are still being added, but flows are smaller and bearish positioning has inched off this year's high.

RBC GBP positioning data - https://fingfx.thomsonreuters.com/gfx/mkt/12/4909/4866/RBC%20GBP%20positioning%20data.jpg

"It is hard to sustain positioning levels that are this extreme, so I'd expect sterling to appreciate a little in the weeks ahead as some of this positioning begins to wash out," said RBC quant trader Robert Turner who has "a tactical long position" in the pound.

Many reckon the calm will end once parliament returns and the Brexit deadline approaches, however.

Richard Oliver, head of cash FX trading for EMEA at HSBC, one of the leading investment banks in foreign exchange trading, said short pound positions were reduced as the currency fell toward $1.20. More recently, though, his clients have started adding shorts, he said.

Similarly, a positioning index from currency fund Millennium fell to minus 1.7 on Aug 13, from -1.4 the week before on a -5 to +5 scale.

Heavy short positioning may slow down sterling depreciation for now, but the no-deal Brexit risk means a bigger sterling adjustment may ultimately be needed, said Claire Dissaux, Millenium's head of global economics.