(Bloomberg) -- A shrinking supply of Japanese government bonds is causing havoc in money markets as the Bank of Japan seeks to buy an increasing amount of debt and dealers refuse to sell.

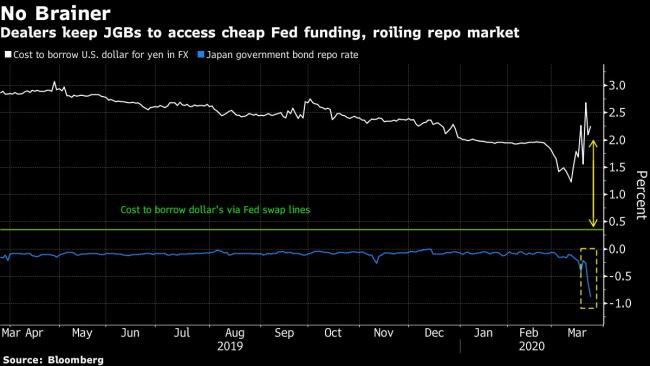

Rates in Japan’s repurchase market -- where bond holders connect with investors looking to borrow them -- hit a record Tuesday. The introduction of cheaper, more regular dollar-swap auctions has generated huge demand from U.S. currency-starved dealers who are keeping their JGBs to put them down as collateral.

“Demand for JGBs as collateral and its importance now is heightening.” Souichi Takeyama, a rates strategist at SMBC Nikko Securities in Tokyo, said. “There is little incentive to sell to the BOJ because there are more effective ways to make use of JGBs.”

The repo rate dropped to minus 0.88% on Tuesday. A negative rate means that the buyer of the repo -- the investor lending the cash for bonds -- ends up paying interest.

The surge in demand comes just as the Bank of Japan steps up JGB purchases to provide liquidity to financial markets grappling with the worsening coronavirus outbreak. Net-net that means less supply available for Japanese banks who have so far tapped more than $150 billion in ultra-cheap dollar funding.

For example, in the first round of the Federal Reserve’s revamped dollar-swap auctions last week, banks were able to borrow greenbacks for about three months at 0.37%, a massive discount to the near 2% it would cost them in the currency swap market. About $32 billion was alloted.

The huge difference in borrowing costs means JGB holders are reluctant to participate in the BOJ’s bond purchases. Monday’s operation across five to 10-year bonds saw the lowest offer-to-cover ratio on record. Other tenors also saw a sharp drop in the amount of bonds offered for sale to the central bank.

The deeply negative repo rate prompted the BOJ to conduct repo operations and announce additional measures to maintain stability in the market. That saw the rate bounce to -0.28% on Wednesday. Longer-dated repo rates, such as for one month, continue to print near the most negative levels on record.

“There is a risk that the BOJ offers may not get sufficient bids,” said Takeyama. “Players are also wary of actively participating ahead of the fiscal year-end on March 31.”

The situation in Europe is less acute despite an ever shrinking pool of available German bonds. Foreign claims by European banks have been trending downward since the 2008 global financial crisis, according to a BIS report cited by the Bank of Japan last year.

The European Central Bank alloted $17.3 billion and $27.8 billion to banks in seven- and 84-day dollar liquidity operations respectively on Wednesday.

(Adds euro-area details from the penultimate paragraph)

©2020 Bloomberg L.P.