By Tetsushi Kajimoto

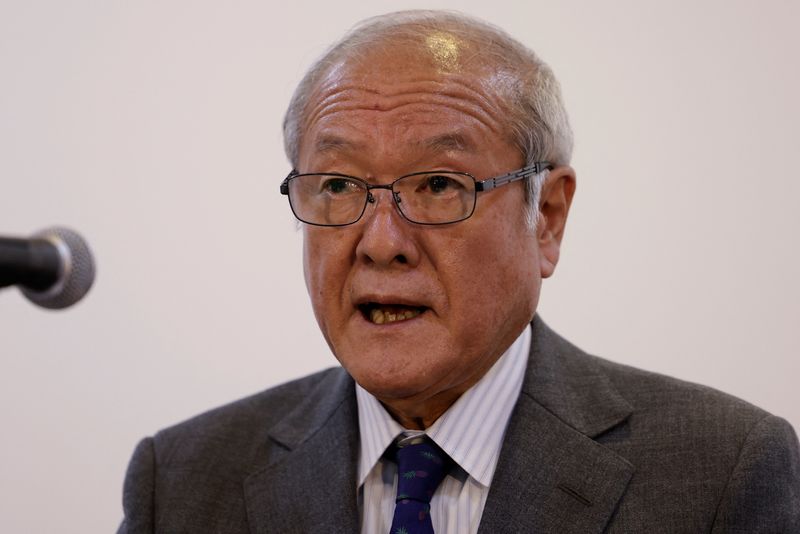

TOKYO (Reuters) -Japan would not rule out any measures to rein in weakness in the yen, finance minister Shunichi Suzuki said in the latest warning against speculators as the nation navigates a delicate period after last week's historic shift away from years of easy policy.

Echoing concerns from Japan's top currency diplomat the previous day, Suzuki said on Tuesday that a weak yen has positive and negative effects on the economy but excess volatility raises uncertainty for business operations.

This in turn could hurt the economy, the minister said, reinforcing Tokyo's focus on the velocity of market moves, rather than on specific currency levels.

"Rapid currency moves are undesirable," Suzuki told reporters after a cabinet meeting. "It is important for currencies to move stably, reflecting economic fundamentals."

The yen's sell-off picked up pace in the wake of last week's landmark decision by the Bank of Japan to end eight years of negative interest rates, ushering in a new era of tighter monetary policy in a nation where cheap money had been the norm for decades.

The first rate hike in Japan since 2017, however, was well telegraphed to markets, triggering a slide in the yen in a classic 'sell-the-fact' trade. Crucially, yen bears have been emboldened by market expectations that the BOJ will raise rates only marginally in coming months, meaning Japanese-U.S. rate differentials will remain stark for a while longer.

A weak yen boosts Japanese exporters' profits, but it also raises the costs of imports and squeezes households' wealth. Policymakers are particularly sensitive to factors threatening consumption as that would undo years of trying to create a virtuous cycle of demand-led price and economic growth.

The dollar was off slightly against the yen in Tuesday afternoon trade, fetching 151.26 and facing great resistance near the 152 level due to the threat of intervention from Japanese authorities. The greenback is up about 7% on the yen since the start of the year.

"It wouldn't surprise me if authorities intervene in the currency market if it breaks past 152 yen," said Makoto Noji, chief market strategist at SMBC Nikko Securities in Japan.

Suzuki declined to comment on the possibility of Tokyo intervening to stem the yen weakness, but suggested the speed of the currency's fluctuations will be a factor in any decision to enter the market.

"If I answer the question about currency intervention, it could have unintended effects on the market," Suzuki said, adding "if there's excessive moves, we will respond appropriately without ruling out any measures."

Japan last intervened in the currency market in September and October 2022 to stem the yen's declines, initially when the dollar hit around 145 to the yen, and later in October when the U.S. currency surged to a 32-year high near 152 levels.

"Behind the yen weakening lies not only speculators but also retail investors who have appetite for foreign stock markets," SMBC Nikko Securities' Noji said.

"The government must be careful not to disturb such investment flows too much. That said, authorities may have no choice but to arrest the dollar's ascent towards 160 yen."