Investing.com - The yen gained further in Asia on Thursday after corporate price index data came in as expected, while the Aussie rebounded on a mixed set of capital expenditure figures.

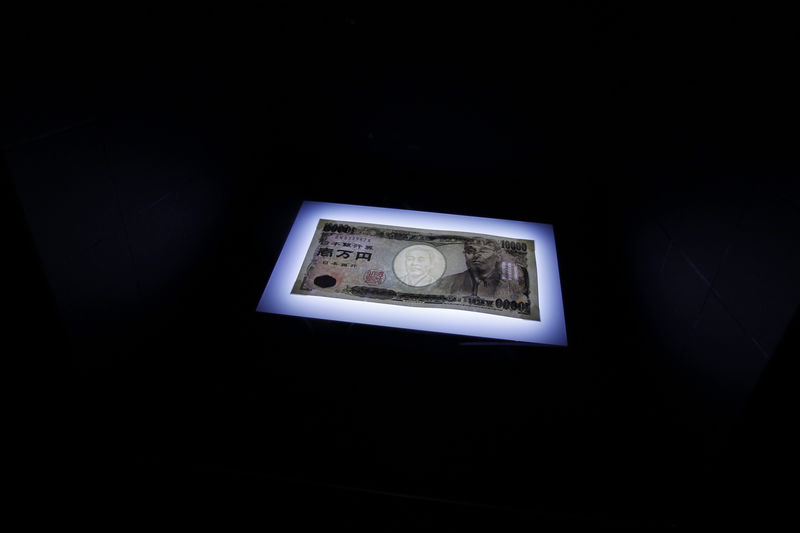

USD/JPY changed hands at 109.62, down 0.51%, while AUD/USD changed hands at 0.7211, up 0.18%.

In Japan, the corporate services price index rose 0.2% as expected year-on-year.

In Australia, building capital expenditure dropped 7.9%, more than double the 3.0% fall month-on-month expected in the first quarter and plant/machinery capital expenditure eased 0.5%, less than the 2.0% drop seen quarter-on-quarter. Private new capital expenditure fell 5.2%, more than the 3.0% decline seen quarter-on-quarter.

The fall in capex in the first quarter was more than expected but the outlook for 2016-17 capex was slightly better than expected. The RBA will be watching this carefully as the continued rebalancing of the economy away from resources depends crucially on growth in the services sector.

New Zealand reported details of its upcoming fiscal year budget with a net debt forecast of 24.90% seen, down from 26.90% earlier.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, fell 0.23% to 95.18.

Overnight, the dollar held steady at two-month highs against the other major currencies on Wednesday, as expectations for a June rate hike in the U.S. continued to boost demand for the greenback.