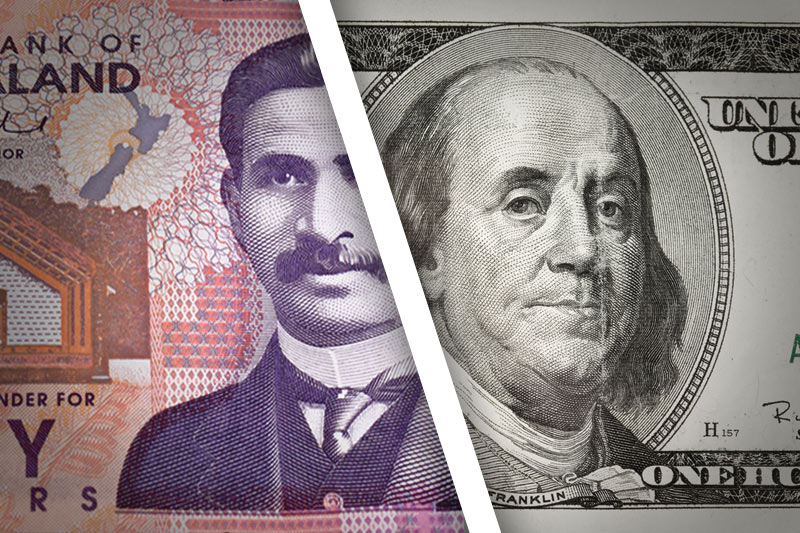

Investing.com- The New Zealand dollar, colloquially referred to as the kiwi, continued its torrid pace against its U.S. counterpart during Thursday’s Asian session prompting some market participants to fret about crimped profits for the country’s exporters.

In Asian trading Thursday, NZD/USD climbed 0.08% 0.8443, backing off the high off 0.8444 set earlier in the session, but still good enough for the pair’s highest levels since February. The pair was likely to find support at 0.8335, Tuesday's low and resistance at 0.8472, the high of February 29.

The kiwi, one of the so-called riskier currencies, caught a bid after the Federal Reserve said it will purchase $45 billion in short-term Treasuries and longer-dated U.S. government bonds when Operation Twist expires at the end of this month.

As expected, the Fed did not reduce interest rates, but central bank pledged to consider rate increases until the U.S. jobless rate drops below 6.5%. It currently stands at 7.7%. The central bank concluded its final monetary policy meeting of 2012 before U.S. markets closed Wednesday.

Elsewhere, AUD/NZD slipped 0.1% to 1.2500. Earlier this week, the New Zealand dollar touched a five-week against its Australian rival. AUD/NZD has been sliding since the Reserve Bank of Australia cut interest rates by 25 basis points to 3% earlier this month.

Following the RBA announcement, Reserve Bank of New Zealand governor Graeme Wheeler essentially ruled out a rate cut in his country and that may be helping stoke the kiwi’s fire.

The New Zealand is looking impressive against some of the majors as well. NZD/JPY is surging 0.46% to 70.56. Those are the highest levels for kiwi against the yen since October 2009, the dark days of the global financial crisis.

In Asian trading Thursday, NZD/USD climbed 0.08% 0.8443, backing off the high off 0.8444 set earlier in the session, but still good enough for the pair’s highest levels since February. The pair was likely to find support at 0.8335, Tuesday's low and resistance at 0.8472, the high of February 29.

The kiwi, one of the so-called riskier currencies, caught a bid after the Federal Reserve said it will purchase $45 billion in short-term Treasuries and longer-dated U.S. government bonds when Operation Twist expires at the end of this month.

As expected, the Fed did not reduce interest rates, but central bank pledged to consider rate increases until the U.S. jobless rate drops below 6.5%. It currently stands at 7.7%. The central bank concluded its final monetary policy meeting of 2012 before U.S. markets closed Wednesday.

Elsewhere, AUD/NZD slipped 0.1% to 1.2500. Earlier this week, the New Zealand dollar touched a five-week against its Australian rival. AUD/NZD has been sliding since the Reserve Bank of Australia cut interest rates by 25 basis points to 3% earlier this month.

Following the RBA announcement, Reserve Bank of New Zealand governor Graeme Wheeler essentially ruled out a rate cut in his country and that may be helping stoke the kiwi’s fire.

The New Zealand is looking impressive against some of the majors as well. NZD/JPY is surging 0.46% to 70.56. Those are the highest levels for kiwi against the yen since October 2009, the dark days of the global financial crisis.