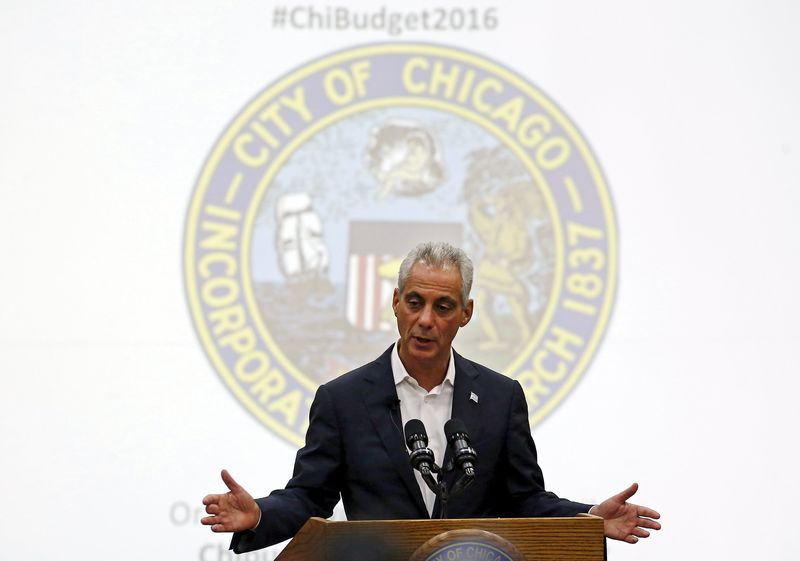

CHICAGO (Reuters) - Chicago Mayor Rahm Emanuel on Tuesday will propose the biggest-ever property tax hike for the cash-strapped city, $543 million over four years, as part of a plan to bring structural balance to the budget, the city announced on Monday.

In addition to the property tax hike, which would start with a $318 million jump on 2016 tax bills to pay for police and fire fighter pensions, the mayor also wants to raise about $112 million from the city's first-ever fee on garbage collection, new surcharges on ride sharing services like Uber and a tax on e-cigarettes, according to city documents.

Resistance to the plan is expected from some of the city's 50 aldermen, who have been scrambling to come up with alternatives to higher property taxes. Ed Burke, who chairs the Chicago City Council's Finance Committee, is floating a congestion tax on non-city residents and commercial vehicles traveling downtown.

"We don't have the luxury of not thinking outside the box," Burke told reporters on Monday before a city finance committee meeting.

As escalating pension payments push Chicago's finances deeper into the red, Emanuel is hoping Illinois lawmakers will stretch out payments to its public safety worker retirement funds. Under a 2010 state law that mandates actuarial payments to public safety pension in order to reach a 90 percent funded level by 2040, the city will see a $550 million jump in contributions.

However, new state legislation would reduce that amount to $318 million and allow for smaller increases through 2020 than the 2010 law allows, as well as lengthen the time frame for the police and fire funds to become 90 percent funded to 2055. That would be 15 years longer than the current law. It is yet unclear whether Republican Governor Bruce Rauner would sign the measure into law.

Moody's Investors Service in May cut Chicago's credit rating to junk, citing the city's $20 billion unfunded pension liability and its limited options to enact cost-saving reforms.

Chicago property owners would also get whacked with an additional $45 million hike the mayor will recommend to pay for Chicago Public Schools' capital projects. To soften the blow, Emanuel is again seeking help from the Illinois legislature to expand the homeowners' exemption to properties valued at $250,000 or less.

The mayor's $3.6 billion operating budget for the fiscal year beginning Jan. 1 will include $170 million in spending cuts and fees to plug a budget hole of at least $332 million, city finance officials said.

People who use taxis and ride-sharing services would be hit with a new per ride surcharge, while companies such as Uber would be able to expand their services to Chicago airports with a $5 per ride surcharge.

Once free garbage collections for residences now would cost $9.50 a month. At the same time, revised building permit fees would raise $13 million, while beefed-up debt collection would capture $23.4 million.

One-time revenue measures in the budget would raise $125 million from debt restructuring and fund sweeps would total $20.2 million. Another $4.8 million would be realized from city-owned land sales.