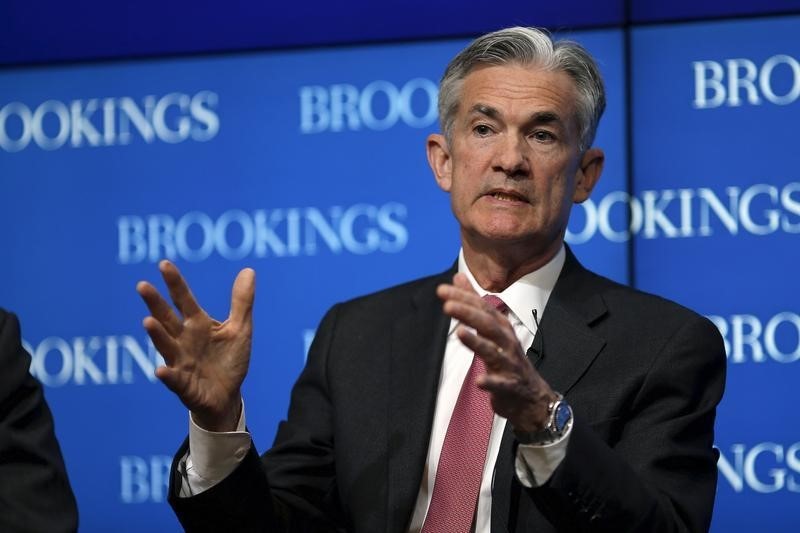

Investing.com - The U.S. dollar struggled for direction on Friday as Federal Reserve Chairman Jerome Powell said he would change the balance sheet if needed.

Powell, who was speaking at a Brookings Institution event along with Janet Yellen and Ben Bernanke, said that the Fed would act “quickly” if market concerns outweigh the strong economic data.

“We will be prepared to adjust policy quickly and flexibly should that be needed,” he said.

Powell also noted that despite trade tensions weighing on Chinese consumers, he expects China and other emerging markets to “remain consistent” with the rest of the growth in the world.

Upbeat jobs data released earlier in the session increased the chance that the Federal Reserve will raise rates next year.

The U.S. dollar index, which measures the greenback’s strength against a basket of six major currencies, slipped 0.11% to 95.77. The dollar was higher against the yen, with USD/JPY rising 0.6% to 108.31.

Meanwhile, the EUR/USD was unchanged at 1.1401 due to the higher dollar and disappointing eurozone data. Eurozone consumer prices rose at a slower-than-expected pace in December, increasing expectations that the European Central Bank will keep interest rates unchanged.

Sterling was higher as the the services sector accelerated in December. Still, the economy is losing momentum ahead of the UK’s departure from the European Union. GBP/USD increased 0.44% to 1.2686.

USD/CAD fell 0.7% to 1.3387 while NZD/USD rose 0.5% to 0.6724 and AUD/USD jumped 1.26% to 0.7091.