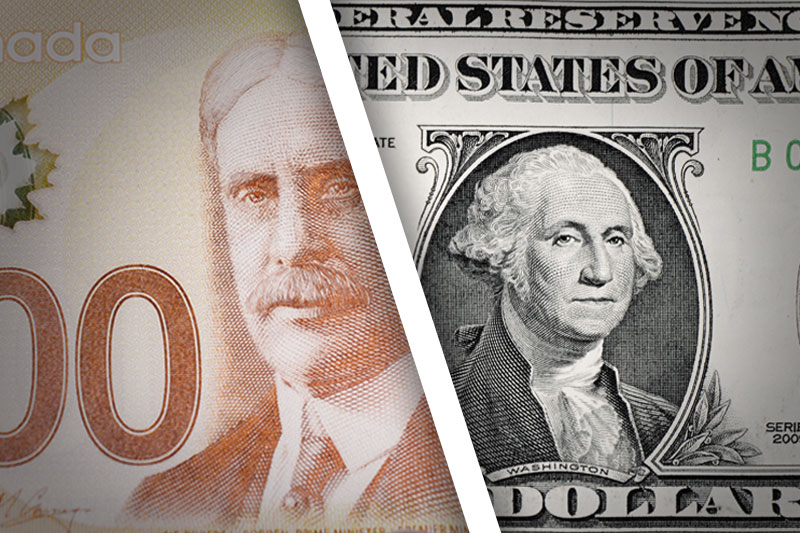

Investing.com – The dollar fell against a basket of major currencies on Monday weighed by a rise in the loonie on a more positive outlook on NAFTA negotiations and an uptick in expectations that the Bank of Canada could raise rates again this year.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, fell 0.32% to 89.53.

The loonie rose sharply pressuring USD/CAD to C$1.2697, down 0.67%, after the Bank of Canada's first-quarter Business Outlook Survey revealed an uptick in inflation expectations, raising the prospect of further Canadian rate hikes this year.

Also supporting an uptick in the loonie were comments from White House National Economic Council director Larry Kudlow who told CNBC that "good progress is being made on North American Free Trade Association talks."

USD/JPY traded roughly flat at Y106.94, paring earlier gains, as trade-war fears lingered despite positive comments from President Donald Trump and White House economic adviser Larry Kudlow.

Kudlow told CNBC he doesn't "know whether we're going to have tariffs or not," but it is possible "we may be able to settle this [trade disputes] with negotiations."

EUR/USD, meanwhile, rose 0.33% to $1.2321 after the European Central Bank’s annual report Monday revealed the bank was optimistic on growth despite ongoing uncertainties.

ECB President Mario Draghi said in the report that the ECB expected the "pace of economic expansion to remain strong in 2018." The report, warned, however, that there were "still uncertainties about the degree of slack in the economy."

GBP/USD rose 0.33% to $1.4136, buoyed by positive U.K. housing data.