Investing.com’s stocks of the week

Investing.com – Last week saw the euro close trading at a 5-month high against the broadly weaker U.S. dollar after soft U.S. data fuelled speculation that the Federal Reserve could introduce stimulus measures to boost the slowing U.S. economy.

Data released on Friday showed that U.S. durable goods orders declined in line with expectations in August, while new home sales were flat over the month. On Thursday, official data showed that U.S. initial jobless claims rose more-than-expected in the preceding week.

Earlier in the week, in their monetary policy statement for October, Fed officials said the U.S. economic recovery would remain modest in the near term and indicated concern over sluggish U.S. growth and continuing low levels of inflation.

Meanwhile, the pound ended the week at a 6-week high, while the dollar also weakened against Swiss franc and closed trading at a 7-day low against the yen, its lowest level since Japan's September 15 intervention.

Elsewhere, Australia's dollar advanced to its highest level since July 2008 amid speculation that the country's central bank will hike interest rates further this year.

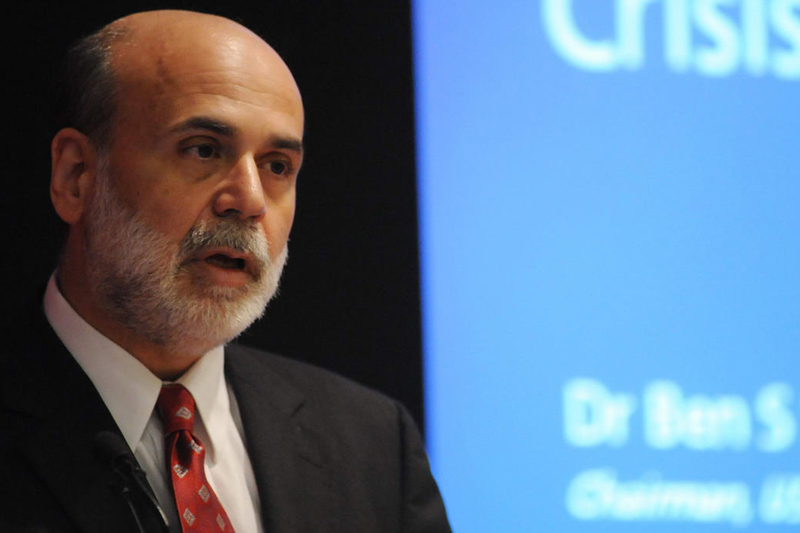

In the week ahead, the U.S. is to release key weekly data on initial jobless claims as well as data on unemployment, consumer confidence and manufacturing. The country is also to release final GDP data while Federal Reserve chief Ben Bernanke is to speak at two public engagements.

In the euro zone, Germany will dominate, releasing data on consumer climate, retail sales and inflation as well as a report on unemployment. Meanwhile, European Central Bank president Jean-Claude Trichet is to speak at two engagements.

Elsewhere, Britain is to release key reports on its current account and manufacturing. In addition, the country is to release data on consumer confidence and house prices. Meanwhile, Japan is to release key data on manufacturing while Switzerland is to publish an index of leading indicators as well as data on retail sales.

Also next week, Australia is to release data on building approvals while New Zealand is to publish key data on business confidence. Finally, Canada is to release a monthly report on GDP.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, September 27

ECB President Jean-Claude Trichet will begin the week by speaking at two engagements. His comments will be closely scrutinized for any clues to the future direction of euro zone monetary policy.

Also Monday, the Governor of the Bank of Japan is to give a speech which will be closely watched for any hints about further Japanese intervention in currency markets.

Tuesday, September 28

The U.S. is to publish data on consumer confidence, a leading indicator of consumer spending, which accounts for approximately 70% of all economic activity. The country is also to release industry data on house prices.

In the euro zone, Germany is to release data on consumer climate and preliminary data on consumer price inflation. Also Tuesday, the U.K. is to release final data on GDP, the leading indicator of economic growth, as well as data on the country's current account and industry data on retail sales.

Elsewhere, Switzerland is to publish an index of consumer based economic indicators, Japan is to publish key manufacturing data and New Zealand is to release important data on its trade balance.

Wednesday, September 29

In the U.S., President of the Federal Reserve Bank of Boston Eric Rosengren is due to speak on the nation’s economy. His comments will be closely scrutinized for any clues to the future direction of monetary policy. The country is also to produce data on crude oil inventories.

The U.K. is to produce data on net lending to individuals as well as data on mortgage approvals, a leading indicator of health in the housing industry. Later in the day, market research group Gfk will publish a report on U.K. consumer confidence.

In Switzerland, the KOF research group is to publish an index of leading economic indicators, designed to predict the direction of the economy over the following six months.

Also Wednesday, Canada is to produce key data on its raw material price index, a leading indicator of consumer inflation, while New Zealand is due to release key data on building consents.

Australia is to publish an index of leading economic indicators, as well as data on new home sales. Japan is to publish key data on retail sales as well as preliminary data on industrial production.

Thursday, September 30

The U.S. is to release final data on its gross domestic product, the leading indicator of economic growth. The country is also due to produce key data on initial jobless claims and manufacturing activity in Chicago.

Later in the day, Federal Reserve Chairmen Ben Bernanke is expected to deliver a speech on the U.S. economy. His comments will be closely scrutinized for any clues to the future direction of monetary policy.

The euro zone is due to produce preliminary data on inflation, while Germany is due to release a report on unemployment change.

The U.K. is to produce industry data on house prices, while Bank of England Monetary Policy Committee members Paul Tucker and Paul Fisher are both expected to deliver speeches on the country’s economy.

Australia is due to release official data on building approvals, while the Reserve Bank of Australia is to publish its financial stability review, an assessment of conditions in the financial system and potential risks to financial stability.

Elsewhere, Canada is to publish monthly data on its gross domestic product. Following the report, Bank of Canada Governor Mark Carney is due to speak on the country’s economy.

Meanwhile, New Zealand is to produce data on business confidence, while Japan is to release key data on its unemployment rate, household spending and consumer prices, a leading indicator of overall inflation.

Friday, October 1

The U.S. is to end the week by producing key data on personal spending and income, while the University of Michigan is to release revised data on consumer sentiment and inflation expectations. The country is also to release official data on manufacturing conditions, total vehicle sales and construction spending.

The euro zone is to produce key data on the region’s unemployment rate and manufacturing activity, while Germany is to release data on retail sales.

Meanwhile, the U.K. is due to publish a report on manufacturing activity and house prices, a leading indicator of health in the housing sector.

Elsewhere, Switzerland is to produce key data on retail sales and manufacturing activity, while Australia is to release data on commodity prices and inflation.

Data released on Friday showed that U.S. durable goods orders declined in line with expectations in August, while new home sales were flat over the month. On Thursday, official data showed that U.S. initial jobless claims rose more-than-expected in the preceding week.

Earlier in the week, in their monetary policy statement for October, Fed officials said the U.S. economic recovery would remain modest in the near term and indicated concern over sluggish U.S. growth and continuing low levels of inflation.

Meanwhile, the pound ended the week at a 6-week high, while the dollar also weakened against Swiss franc and closed trading at a 7-day low against the yen, its lowest level since Japan's September 15 intervention.

Elsewhere, Australia's dollar advanced to its highest level since July 2008 amid speculation that the country's central bank will hike interest rates further this year.

In the week ahead, the U.S. is to release key weekly data on initial jobless claims as well as data on unemployment, consumer confidence and manufacturing. The country is also to release final GDP data while Federal Reserve chief Ben Bernanke is to speak at two public engagements.

In the euro zone, Germany will dominate, releasing data on consumer climate, retail sales and inflation as well as a report on unemployment. Meanwhile, European Central Bank president Jean-Claude Trichet is to speak at two engagements.

Elsewhere, Britain is to release key reports on its current account and manufacturing. In addition, the country is to release data on consumer confidence and house prices. Meanwhile, Japan is to release key data on manufacturing while Switzerland is to publish an index of leading indicators as well as data on retail sales.

Also next week, Australia is to release data on building approvals while New Zealand is to publish key data on business confidence. Finally, Canada is to release a monthly report on GDP.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, September 27

ECB President Jean-Claude Trichet will begin the week by speaking at two engagements. His comments will be closely scrutinized for any clues to the future direction of euro zone monetary policy.

Also Monday, the Governor of the Bank of Japan is to give a speech which will be closely watched for any hints about further Japanese intervention in currency markets.

Tuesday, September 28

The U.S. is to publish data on consumer confidence, a leading indicator of consumer spending, which accounts for approximately 70% of all economic activity. The country is also to release industry data on house prices.

In the euro zone, Germany is to release data on consumer climate and preliminary data on consumer price inflation. Also Tuesday, the U.K. is to release final data on GDP, the leading indicator of economic growth, as well as data on the country's current account and industry data on retail sales.

Elsewhere, Switzerland is to publish an index of consumer based economic indicators, Japan is to publish key manufacturing data and New Zealand is to release important data on its trade balance.

Wednesday, September 29

In the U.S., President of the Federal Reserve Bank of Boston Eric Rosengren is due to speak on the nation’s economy. His comments will be closely scrutinized for any clues to the future direction of monetary policy. The country is also to produce data on crude oil inventories.

The U.K. is to produce data on net lending to individuals as well as data on mortgage approvals, a leading indicator of health in the housing industry. Later in the day, market research group Gfk will publish a report on U.K. consumer confidence.

In Switzerland, the KOF research group is to publish an index of leading economic indicators, designed to predict the direction of the economy over the following six months.

Also Wednesday, Canada is to produce key data on its raw material price index, a leading indicator of consumer inflation, while New Zealand is due to release key data on building consents.

Australia is to publish an index of leading economic indicators, as well as data on new home sales. Japan is to publish key data on retail sales as well as preliminary data on industrial production.

Thursday, September 30

The U.S. is to release final data on its gross domestic product, the leading indicator of economic growth. The country is also due to produce key data on initial jobless claims and manufacturing activity in Chicago.

Later in the day, Federal Reserve Chairmen Ben Bernanke is expected to deliver a speech on the U.S. economy. His comments will be closely scrutinized for any clues to the future direction of monetary policy.

The euro zone is due to produce preliminary data on inflation, while Germany is due to release a report on unemployment change.

The U.K. is to produce industry data on house prices, while Bank of England Monetary Policy Committee members Paul Tucker and Paul Fisher are both expected to deliver speeches on the country’s economy.

Australia is due to release official data on building approvals, while the Reserve Bank of Australia is to publish its financial stability review, an assessment of conditions in the financial system and potential risks to financial stability.

Elsewhere, Canada is to publish monthly data on its gross domestic product. Following the report, Bank of Canada Governor Mark Carney is due to speak on the country’s economy.

Meanwhile, New Zealand is to produce data on business confidence, while Japan is to release key data on its unemployment rate, household spending and consumer prices, a leading indicator of overall inflation.

Friday, October 1

The U.S. is to end the week by producing key data on personal spending and income, while the University of Michigan is to release revised data on consumer sentiment and inflation expectations. The country is also to release official data on manufacturing conditions, total vehicle sales and construction spending.

The euro zone is to produce key data on the region’s unemployment rate and manufacturing activity, while Germany is to release data on retail sales.

Meanwhile, the U.K. is due to publish a report on manufacturing activity and house prices, a leading indicator of health in the housing sector.

Elsewhere, Switzerland is to produce key data on retail sales and manufacturing activity, while Australia is to release data on commodity prices and inflation.