Investing.com – Last week saw the U.S. dollar come under broad selling pressure as weak U.S. economic data added to fears that the Federal Reserve may need to implement further monetary easing measures to bolster the flagging U.S. economy.

On Friday, official data showed that U.S. non-farm payrolls fell unexpectedly in September, down for the fourth consecutive month. Following the report, the dollar plunged to a fresh 15-year low against the yen, with no signs of Japanese intervention seen.

The euro also advanced against the dollar following the jobs data but pared gains to close just below an 8-month high after the head of the euro zone’s finance ministers, Jean-Claude Juncker said that the euro was too strong and the single currency’s strength did not reflect the region's economic fundamentals.

On Saturday, the International Monetary Fund and the World Bank held their twice-yearly meeting in Washington with world financial leaders looking at how best to address worsening tensions among countries vying to keep their currencies weak and exports competitive.

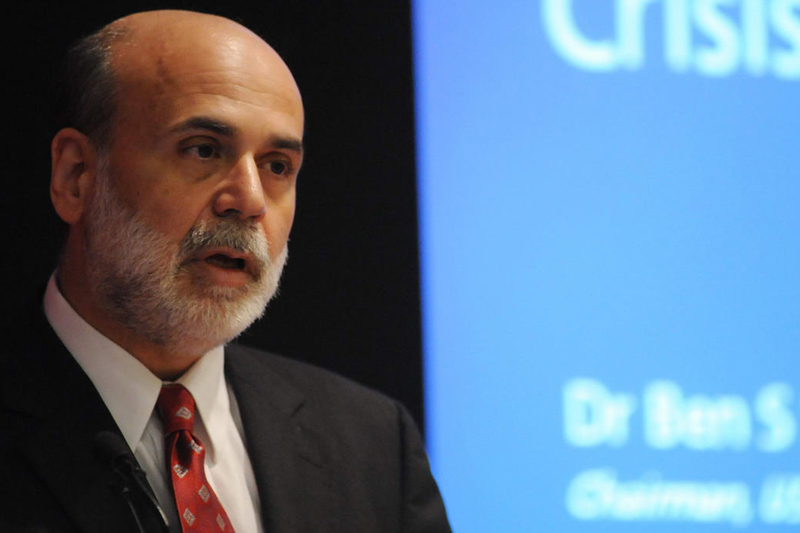

Next week, the U.S. is to publish its closely watched weekly report on initial jobless claims as well as key data on inflation, retail sales and consumer sentiment. In addition, Federal Reserve chairman Ben Bernanke is to speak at two public engagements, while the bank is to publish the minutes of the most recent meeting of its monetary policy committee.

The euro zone is to release data on inflation and industrial production while European Central Bank president Jean Claude Trichet is to appear at a number of public engagements. Meanwhile, the U.K. is to release key data on employment and inflation as well as industry data on retail sales and house prices.

Elsewhere, Australia is to release official data on housing while Canada is to publish a report on its trade balance. New Zealand is to publish official data on retail sales and Switzerland is to publish key data on Inflation.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, October 11

Australia will begin the week with official data on the change in the number of new loans granted for owner-occupied homes, a leading indicator of demand in the housing market.

In the euro zone, ECB President Jean Claude Trichet is to give a speech; his comments will be closely watched for any clues to the future direction of monetary policy. The euro zone is also to publish reports on industrial production in France and Italy.

Also Monday, the U.K. is to publish industry data on retail sales and house prices, while markets in the U.S., Canada and Japan will remain closed for Bank Holidays.

Tuesday, October 12

The U.K. is to publish official data on consumer price inflation, a leading indicator of economic growth. The country is also to publish data on consumer confidence and its trade balance, the difference in value between imported and exported goods during the month.

The U.S. is to publish the minutes of the most recent meeting of the Federal Reserve’s Federal Open Market Committee. The minutes provide in-depth insights into the economic conditions that influenced their vote on where to set interest rates.

Elsewhere, Australia is to publish data on business confidence and consumer sentiment while Japan is to publish official data on machinery orders, a leading indicator of industrial production. Also Tuesday, ECB President Jean Claude Trichet is to give a speech.

Wednesday, October 13

The U.S. is to release key data on import prices, while Federal Reserve Chairman Ben Bernanke is to speak at a public engegment, his comments will be closely scrutinized for any clues to the future direction of monetary policy.

Also Wednesday, the euro zone is to produce official data on industrial production, while France is to release information on consumer price inflation.

The U.K. is to produce data on the change in the number of people unemployed during the previous month, as well as data on the country’s overall unemployment rate and average cash earnings. The country is also to publish an index of leading economic indicators, designed to predict the future direction of the economy. Later in the day, Bank of England Monetary Policy Committee member Andrew Sentence is due to speak at a public engagement in London.

Elsewhere, New Zealand is to release key data on retail sales and manufacturing activity, while Canada is to publish data on house prices, a leading indicator of economic health. Also, Switzerland is to publish a report on its producer price index, a leading indicator of consumer inflation.

Thursday, October 14

The U.S. is to release key weekly data on initial jobless claims, as well as data on producer prices, a leading indicator of consumer inflation. The country will also publish official data on its trade balance, as well information on crude oil and natural gas stockpiles.

In the euro zone, the ECB is to release its monthly bulletin, which gives detailed analysis of current and future economic conditions from the bank's point of view. Later in the day, ECB Governing Council Member Axel Weber is to deliver a speech.

In the U.K., Bank of England Monetary Policy Committee member Paul Fisher is to speak at a public engagement. Elsewhere, Canada is to release official data on its trade balance, while Australia is to produce key data on inflation expectations.

Friday, October 15

The U.S. is to round up the week by producing official data on retail sales, business inventories and its consumer price index, while the University of Michigan is to release preliminary data on consumer sentiment and inflation expectations.

Also Friday, the Federal Reserve Bank of New York is due to release key data on the city’s manufacturing sector while Fed chair Ben Bernanke will be speaking at a public engagement.

The euro zone is to produce key data on consumer prices, a leading indicator of inflation, as well as official data on its trade balance.

Elsewhere, Canada is to publish data on new motor vehicle sales as well as manufacturing sales, both leading indicators of economic health. Meanwhile, Japan is to release data on industrial production, while the governor of the country’s central bank, Masaaki Shirakawa is to speak at a public engagement in Tokyo.

On Friday, official data showed that U.S. non-farm payrolls fell unexpectedly in September, down for the fourth consecutive month. Following the report, the dollar plunged to a fresh 15-year low against the yen, with no signs of Japanese intervention seen.

The euro also advanced against the dollar following the jobs data but pared gains to close just below an 8-month high after the head of the euro zone’s finance ministers, Jean-Claude Juncker said that the euro was too strong and the single currency’s strength did not reflect the region's economic fundamentals.

On Saturday, the International Monetary Fund and the World Bank held their twice-yearly meeting in Washington with world financial leaders looking at how best to address worsening tensions among countries vying to keep their currencies weak and exports competitive.

Next week, the U.S. is to publish its closely watched weekly report on initial jobless claims as well as key data on inflation, retail sales and consumer sentiment. In addition, Federal Reserve chairman Ben Bernanke is to speak at two public engagements, while the bank is to publish the minutes of the most recent meeting of its monetary policy committee.

The euro zone is to release data on inflation and industrial production while European Central Bank president Jean Claude Trichet is to appear at a number of public engagements. Meanwhile, the U.K. is to release key data on employment and inflation as well as industry data on retail sales and house prices.

Elsewhere, Australia is to release official data on housing while Canada is to publish a report on its trade balance. New Zealand is to publish official data on retail sales and Switzerland is to publish key data on Inflation.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, October 11

Australia will begin the week with official data on the change in the number of new loans granted for owner-occupied homes, a leading indicator of demand in the housing market.

In the euro zone, ECB President Jean Claude Trichet is to give a speech; his comments will be closely watched for any clues to the future direction of monetary policy. The euro zone is also to publish reports on industrial production in France and Italy.

Also Monday, the U.K. is to publish industry data on retail sales and house prices, while markets in the U.S., Canada and Japan will remain closed for Bank Holidays.

Tuesday, October 12

The U.K. is to publish official data on consumer price inflation, a leading indicator of economic growth. The country is also to publish data on consumer confidence and its trade balance, the difference in value between imported and exported goods during the month.

The U.S. is to publish the minutes of the most recent meeting of the Federal Reserve’s Federal Open Market Committee. The minutes provide in-depth insights into the economic conditions that influenced their vote on where to set interest rates.

Elsewhere, Australia is to publish data on business confidence and consumer sentiment while Japan is to publish official data on machinery orders, a leading indicator of industrial production. Also Tuesday, ECB President Jean Claude Trichet is to give a speech.

Wednesday, October 13

The U.S. is to release key data on import prices, while Federal Reserve Chairman Ben Bernanke is to speak at a public engegment, his comments will be closely scrutinized for any clues to the future direction of monetary policy.

Also Wednesday, the euro zone is to produce official data on industrial production, while France is to release information on consumer price inflation.

The U.K. is to produce data on the change in the number of people unemployed during the previous month, as well as data on the country’s overall unemployment rate and average cash earnings. The country is also to publish an index of leading economic indicators, designed to predict the future direction of the economy. Later in the day, Bank of England Monetary Policy Committee member Andrew Sentence is due to speak at a public engagement in London.

Elsewhere, New Zealand is to release key data on retail sales and manufacturing activity, while Canada is to publish data on house prices, a leading indicator of economic health. Also, Switzerland is to publish a report on its producer price index, a leading indicator of consumer inflation.

Thursday, October 14

The U.S. is to release key weekly data on initial jobless claims, as well as data on producer prices, a leading indicator of consumer inflation. The country will also publish official data on its trade balance, as well information on crude oil and natural gas stockpiles.

In the euro zone, the ECB is to release its monthly bulletin, which gives detailed analysis of current and future economic conditions from the bank's point of view. Later in the day, ECB Governing Council Member Axel Weber is to deliver a speech.

In the U.K., Bank of England Monetary Policy Committee member Paul Fisher is to speak at a public engagement. Elsewhere, Canada is to release official data on its trade balance, while Australia is to produce key data on inflation expectations.

Friday, October 15

The U.S. is to round up the week by producing official data on retail sales, business inventories and its consumer price index, while the University of Michigan is to release preliminary data on consumer sentiment and inflation expectations.

Also Friday, the Federal Reserve Bank of New York is due to release key data on the city’s manufacturing sector while Fed chair Ben Bernanke will be speaking at a public engagement.

The euro zone is to produce key data on consumer prices, a leading indicator of inflation, as well as official data on its trade balance.

Elsewhere, Canada is to publish data on new motor vehicle sales as well as manufacturing sales, both leading indicators of economic health. Meanwhile, Japan is to release data on industrial production, while the governor of the country’s central bank, Masaaki Shirakawa is to speak at a public engagement in Tokyo.