Investing.com – The week beginning November 1 comes after a week which was dominated by uncertainty over fresh monetary easing by the Federal Reserve ahead of the bank’s November 2-3 policy meeting.

The flurry of largely disappointing U.S. data released on Friday seemed to underline expectations that the bank will intervene to support the U.S. economic recovery.

Official data showed that U.S. GDP rose at an annual rate of 2.0% in the third quarter, in line with expectations, after rising 1.7% in the second quarter. However the real final sales component - the measure of demand in the U.S. - rose by only 0.6%. That was down from 0.9% in the second quarter and 1.1% in the first quarter.

Meanwhile, the University of Michigan consumer-sentiment index unexpectedly fell to 67.7 in October. Economists had expected the index to rise to 68.0.

Following the release of the data the dollar closed trading against the yen at 80.37, the lowest close on record.

The week ahead brings a calendar of events capable of shaping currency markets for several weeks to come, with the Fed's November 2-3 Federal Open Market Committee meeting and U.S. nonfarm payrolls.

Elsewhere, four central banks are to announce their benchmark interest rate decisions, with rate statements awaited from the European Central Bank, the Bank of England, the Bank of Japan and the Reserve Bank of Australia.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, November 1

Australia will begin the week with the release of official data on house price changes, a leading indicator of health in the housing sector. The U.K. is to publish data on manufacturing PMI, a leading indicator of manufacturing production.

Later in the day, the U.S. is to publish official data on personal income and personal spending, which accounts for the majority of overall economic activity as well as data on manufacturing.

Also Monday, New Zealand is to publish official data on labor costs, a leading indicator of inflation while the Bank of Japan is to publish the minutes of the most recent meeting of its monetary policy committee. The minutes provide an in-depth insight into the economic conditions that influenced the decision on where to set interest rates.

Tuesday, November 2

The Reserve Bank of Australia is to announce its benchmark interest rate. The announcement will be followed by a closely watched rate statement which contains commentary about economic conditions and outlook. Later in the day, the country is to publish industry data on service sector activity.

Also Tuesday, Switzerland is to publish official data on retail sales, a leading indicator of consumer spending. The U.K. is to publish data on construction activity while the euro zone is to release final data on manufacturing growth.

Wednesday, November 3

Australia is to publish official data on building approvals, a leading indicator of growth in the housing sector while the U.K. is to publish official data on service sector growth.

Later in the day, the U.S. is to publish a key monthly report on ADP non-farm employment change, which leads government data by two days. The country is also to publish industry data on service sector growth.

In addition, the Federal Reserve is to announce its benchmark interest rate. The announcement will be followed by the heavily anticipated FOMC rate statement.

Later Wednesday, New Zealand is to publish official data on employment change and the country’s unemployment rate. Meanwhile, markets in Japan will remain closed for a Bank Holiday.

Thursday, November 4

Australia is to publish official data on retail sales and the country’s trade balance, the difference in value between imported and exported goods during the month. Meanwhile, Switzerland is to publish data on consumer price inflation, a leading indicator of economic growth.

Later in the day, the Bank of England is to announce its benchmark interest rate. The announcement will be followed up with keenly anticipated rate statement. The European Central Bank is also to announce its benchmark interest rate. The announcement will be followed by the banks monthly press conference.

Also Thursday, the U.S. is to publish key weekly data on initial jobless claims, the nation’s earliest economic data and a leading indicator of overall economic health. The country is also to publish quarterly data on non-farm productivity and labor costs, both leading inflationary indicators.

Elsewhere, Canada is to publish its Ivey PMI, a leading indicator of economic health.

Friday, November 5

The Reserve Bank of Australia is to publish its monetary policy statement, providing valuable insight into the bank's view of economic conditions and inflation. Also Friday, the Bank of Japan is to announce its benchmark interest rate and publish its monetary policy statement, which will be followed by a closely watched press conference.

Meanwhile, the euro zone is to publish official data on retail sales, while Germany is to produce data on factory orders, a leading indicator of production. The U.K. is to release official data on producer price inflation, a leading indicator of economic growth while Canada is set to release key data on employment change and the country's unemployment rate, as well as data on building permits.

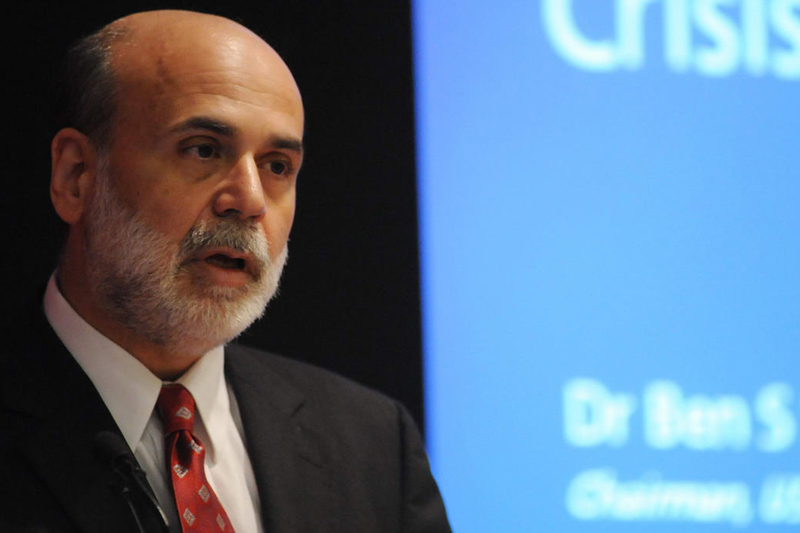

The U.S. is to round up the week with official data on non-farm employment change on the country's overall unemployment rate. The country will also release official data on pending home sales, while Federal Reserve Chairman Ben Bernanke is to deliver a speech at a public engagement. His comments will be closely scrutinized for any clues to the future direction of monetary policy.

The flurry of largely disappointing U.S. data released on Friday seemed to underline expectations that the bank will intervene to support the U.S. economic recovery.

Official data showed that U.S. GDP rose at an annual rate of 2.0% in the third quarter, in line with expectations, after rising 1.7% in the second quarter. However the real final sales component - the measure of demand in the U.S. - rose by only 0.6%. That was down from 0.9% in the second quarter and 1.1% in the first quarter.

Meanwhile, the University of Michigan consumer-sentiment index unexpectedly fell to 67.7 in October. Economists had expected the index to rise to 68.0.

Following the release of the data the dollar closed trading against the yen at 80.37, the lowest close on record.

The week ahead brings a calendar of events capable of shaping currency markets for several weeks to come, with the Fed's November 2-3 Federal Open Market Committee meeting and U.S. nonfarm payrolls.

Elsewhere, four central banks are to announce their benchmark interest rate decisions, with rate statements awaited from the European Central Bank, the Bank of England, the Bank of Japan and the Reserve Bank of Australia.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, November 1

Australia will begin the week with the release of official data on house price changes, a leading indicator of health in the housing sector. The U.K. is to publish data on manufacturing PMI, a leading indicator of manufacturing production.

Later in the day, the U.S. is to publish official data on personal income and personal spending, which accounts for the majority of overall economic activity as well as data on manufacturing.

Also Monday, New Zealand is to publish official data on labor costs, a leading indicator of inflation while the Bank of Japan is to publish the minutes of the most recent meeting of its monetary policy committee. The minutes provide an in-depth insight into the economic conditions that influenced the decision on where to set interest rates.

Tuesday, November 2

The Reserve Bank of Australia is to announce its benchmark interest rate. The announcement will be followed by a closely watched rate statement which contains commentary about economic conditions and outlook. Later in the day, the country is to publish industry data on service sector activity.

Also Tuesday, Switzerland is to publish official data on retail sales, a leading indicator of consumer spending. The U.K. is to publish data on construction activity while the euro zone is to release final data on manufacturing growth.

Wednesday, November 3

Australia is to publish official data on building approvals, a leading indicator of growth in the housing sector while the U.K. is to publish official data on service sector growth.

Later in the day, the U.S. is to publish a key monthly report on ADP non-farm employment change, which leads government data by two days. The country is also to publish industry data on service sector growth.

In addition, the Federal Reserve is to announce its benchmark interest rate. The announcement will be followed by the heavily anticipated FOMC rate statement.

Later Wednesday, New Zealand is to publish official data on employment change and the country’s unemployment rate. Meanwhile, markets in Japan will remain closed for a Bank Holiday.

Thursday, November 4

Australia is to publish official data on retail sales and the country’s trade balance, the difference in value between imported and exported goods during the month. Meanwhile, Switzerland is to publish data on consumer price inflation, a leading indicator of economic growth.

Later in the day, the Bank of England is to announce its benchmark interest rate. The announcement will be followed up with keenly anticipated rate statement. The European Central Bank is also to announce its benchmark interest rate. The announcement will be followed by the banks monthly press conference.

Also Thursday, the U.S. is to publish key weekly data on initial jobless claims, the nation’s earliest economic data and a leading indicator of overall economic health. The country is also to publish quarterly data on non-farm productivity and labor costs, both leading inflationary indicators.

Elsewhere, Canada is to publish its Ivey PMI, a leading indicator of economic health.

Friday, November 5

The Reserve Bank of Australia is to publish its monetary policy statement, providing valuable insight into the bank's view of economic conditions and inflation. Also Friday, the Bank of Japan is to announce its benchmark interest rate and publish its monetary policy statement, which will be followed by a closely watched press conference.

Meanwhile, the euro zone is to publish official data on retail sales, while Germany is to produce data on factory orders, a leading indicator of production. The U.K. is to release official data on producer price inflation, a leading indicator of economic growth while Canada is set to release key data on employment change and the country's unemployment rate, as well as data on building permits.

The U.S. is to round up the week with official data on non-farm employment change on the country's overall unemployment rate. The country will also release official data on pending home sales, while Federal Reserve Chairman Ben Bernanke is to deliver a speech at a public engagement. His comments will be closely scrutinized for any clues to the future direction of monetary policy.