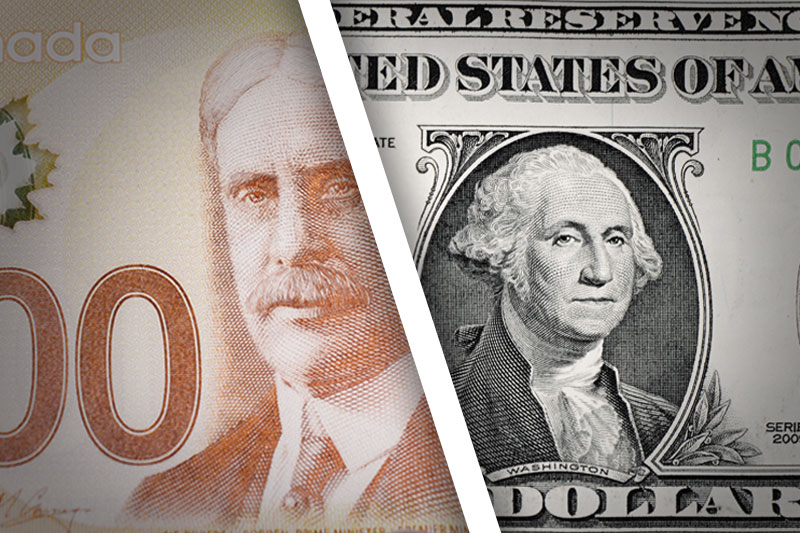

Investing.com - The U.S. dollar edged higher against its Canadian counterpart on Thursday, after the release of positive U.S.. jobless claims data while markets turned to an upcoming report on Canada's Ivey purchasing manager's index due later in the trading session.

USD/CAD hit 1.1397 during early U.S. trade, the session high; the pair subsequently consolidated at 1.1386, adding 0.17%.

The pair was likely to find support at 1.1310, the low of December 1 and resistance at 1.1421, Wednesday's high.

In a report, the U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending November 29 decreased by 17,000 to 297,000 from the previous week’s revised total of 314,000.

The Canadian dollar had strengthened on Wednesday after the Bank of Canada left rates on hold at 1.0% in a widely anticipated decision and said inflation has risen more strongly than expected.

The central bank said the recovery in the U.S. economy has "clearly strengthened" which has benefited Canadian exports. Canada’s economy is showing signs of a broadening recovery the bank said, but noted that lower prices for oil and other commodities will weigh on growth.

The loonie was lower against the euro, with EUR/CAD advancing 0.58% to 1.4077.

The single currency was boosted after European Central Bank President Mario Draghi indicated that it would not embark on quantitative easing for now, saying the bank would reassess its stimulus program in the first quarter of 2015.

Draghi said the bank could potentially change the size, scale and composition of its existing stimulus programs. The governing council remains unanimous that it will take further measures, if necessary, he added.

The ECB substantially revised down its forecasts for growth and inflation and warned that the latest forecasts do not take into account the recent steep drop in oil prices.

Earlier Thursday, the bank left euro zone interest rates on hold at their current record lows of 0.05% earlier Thursday, in a widely anticipated decision.