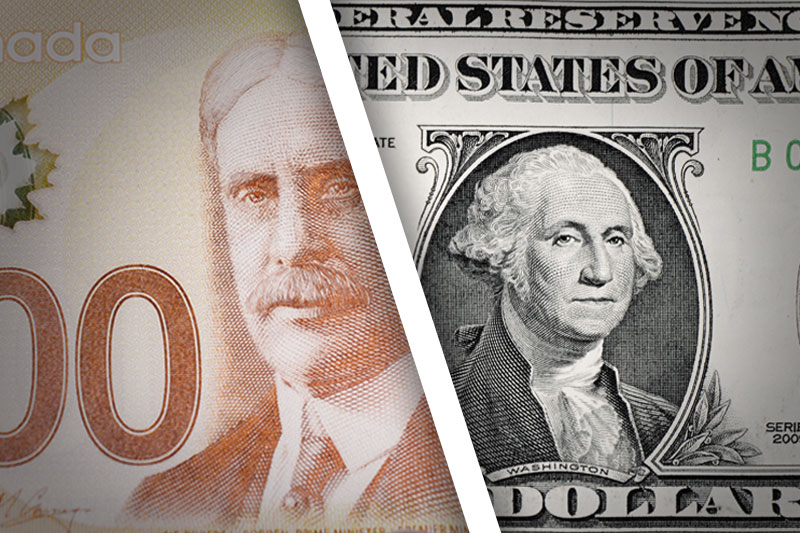

Investing.com - The U.S. dollar fell to two-week lows against the Canadian dollar on Tuesday, as investors looked ahead to a series of major economic events later in the week.

USD/CAD touched lows of 1.0962, the weakest since April 16 and was last down 0.58% to 1.0965.

The pair was likely to find support at 1.0911, the low of April 8 and resistance at 1.1028, the session high.

The Canadian dollar strengthened ahead of the latest report on the country’s economic growth, due for release on Wednesday. Meanwhile Bank of Canada Governor Stephen Poloz was to speak later Tuesday and again on Wednesday.

Investors were also awaiting U.S. data on first quarter growth on Wednesday, as well as the Federal Reserve’s monetary policy statement. The Fed was expected to stick to its current timetable for tapering its asset purchase program, and market participants were waiting to see whether the bank’s rate statement would provide more clarity on the timing of possible interest rates increases.

Meanwhile, Friday’s U.S. nonfarm payrolls report for April was expected to indicate that the recovery in the labor market is continuing.

The pair has traded in a relatively narrow range for the past several sessions as the BoC’s dovish stance weighed.

Late last week, BoC Governor Stephen Poloz said interest rates will stay low for longer, while inflation will remain below the central bank’s 2% target for at least another two years.

The loonie was sharply higher against the euro, with EUR/CAD dropping 0.78% to 1.5153.

The drop in the euro came after official data on Tuesday showed that the annual rate of inflation in Germany rose less than forecast this month, fuelling concerns over the low inflation outlook for the euro zone.

The data came as investors were looking ahead to preliminary data on euro zone inflation, due for release on Wednesday.