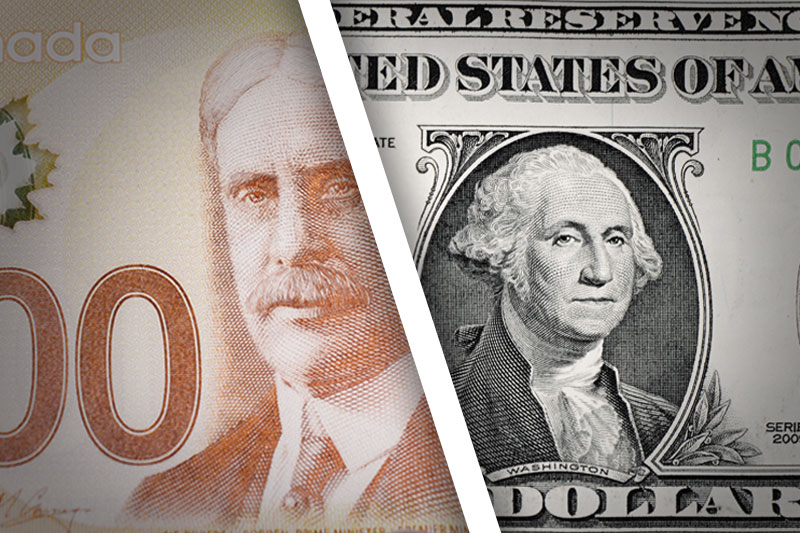

Investing.com - The U.S. dollar extended its pullback from four-and-a-half year highs against the Canadian dollar on Monday, falling to one-week lows after data showed that Canadian producer price inflation rose in December.

USD/CAD was down 0.61% to 1.1058 during early U.S. trade. The pair rose to highs of 1.1223 on Friday, the highest since July 2009.

The pair was likely to find support at 1.1025 and resistance at 1.1132, the session high.

Statistics Canada said producer price inflation rose 0.7% in December from a month earlier and was up 1.4% on a year-over-year basis, driven by higher energy costs and the weaker Canadian dollar.

Canada’s raw materials price index rose 1.9% in December, just below expectations for a 2% gain and was 2.1% higher from a year earlier.

The industrial product price index rose 0.7% in December, missing expectations for a 1% increase, after rising 0.2% in November.

The Canadian dollar had lingering support after data released on Friday showed that the Canadian economy expanded 0.2% in November, in line with expectations but slowing slightly from growth of 0.3% in October.

Elsewhere, the loonie, as the Canadian dollar is also known, was higher against the euro, with EUR/CAD down 0.71% to 1.4913.

In the euro zone, data on Monday showed that the bloc’s manufacturing sector continued to recover in January.

The euro zone’s manufacturing purchasing managers’ index rose to a 32-month high of 54.0 in January, up from 52.7 in December and a shade higher than the preliminary estimate of 53.9.

All of the euro zone’s peripheral countries reported an increase in manufacturing activity in January, with Greece returning to growth for the first time since August 2009.

However, sentiment on the common currency remained fragile after data last week showing that inflation in the euro zone slowed in January fuelled fears that the European Central Bank may tighten policy to stave off the risk of deflation.