Investing.com – Sterling pared losses against the U.S. dollar on Wednesday, clawing back above the 1.52 mark as Bank of England policymakers began a monthly meeting to determine the level of interest rates.

GBP/USD rose from a daily low of 1.5137 to hit 1.5216 during late European trade, still shedding 0.32%. Cable was likely to find resistance at 1.5816, the high of Feb. 17, and support at 1.4781, the low of March 1.

The pair had plummeted earlier in the day after the market research group Markit and the Chartered Institute of Purchasing and Supply said their services PMI fell to 56.5 in March from 58.4 in February. Economists had expected the figure to hold steady at 58.4.

Sterling also bounced versus the euro, with EUR/GBP pulling back from a daily high of 0.8819 to reach 0.8778, still gaining 0.01%.

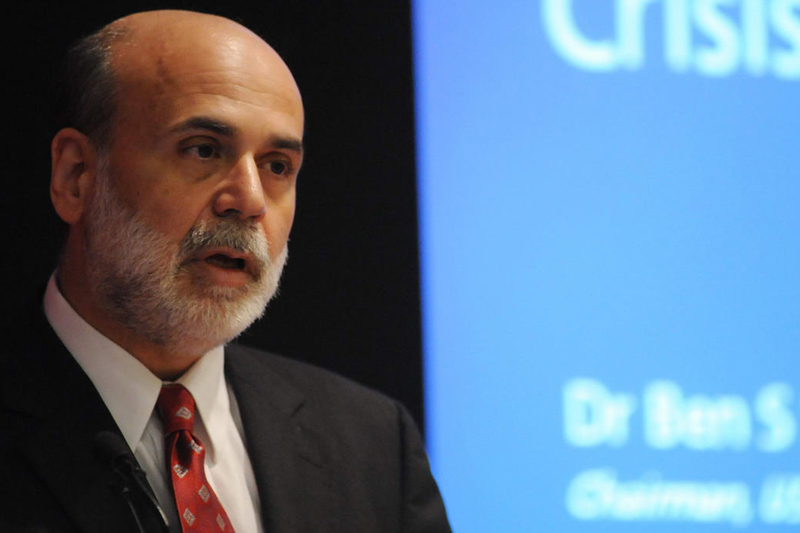

Later Wednesday, the U.S. Federal Reserve chairman, Ben Bernanke, was due to deliver a speech at a conference in Dallas. Traders were likely to scrutinize his comments for clues to future monetary policy shifts.

GBP/USD rose from a daily low of 1.5137 to hit 1.5216 during late European trade, still shedding 0.32%. Cable was likely to find resistance at 1.5816, the high of Feb. 17, and support at 1.4781, the low of March 1.

The pair had plummeted earlier in the day after the market research group Markit and the Chartered Institute of Purchasing and Supply said their services PMI fell to 56.5 in March from 58.4 in February. Economists had expected the figure to hold steady at 58.4.

Sterling also bounced versus the euro, with EUR/GBP pulling back from a daily high of 0.8819 to reach 0.8778, still gaining 0.01%.

Later Wednesday, the U.S. Federal Reserve chairman, Ben Bernanke, was due to deliver a speech at a conference in Dallas. Traders were likely to scrutinize his comments for clues to future monetary policy shifts.