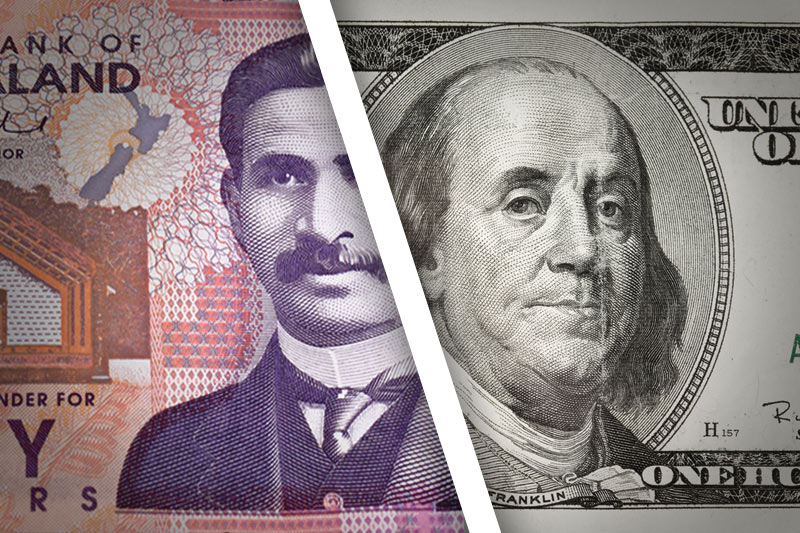

Investing.com - The New Zealand dollar fell sharply against its U.S. counterpart on Friday, as demand for the greenback remained supported amid indications the U.S. economic recovery is gaining enough traction for the Federal Reserve to continue tapering stimulus measures.

NZD/USD fell to 0.8248 on Friday, the pair’s lowest since January 10, before subsequently consolidating at 0.8258 by close of trade, down 1.17% for the day and 0.54% lower for the week.

The pair is likely to find support at 0.8202, the low from January 10 and resistance at 0.8356, Friday’s high.

Data released on Friday showed that U.S. industrial production rose 0.3% in December, in line with expectations, rising for the fifth successive month.

Another report showed that U.S. housing starts fell to 999,000 units last month from an upwardly revised 1.11 million in November, better than expectations for a decline to 990,000 units. U.S. building permits dropped to 986,000 in December, but held close to November’s five year highs of 1.01 million units.

Separately, data showed that the University of Michigan's consumer sentiment index ticked down to 80.4 in January from 82.5 in December. Analysts had expected the index to rise to 83.5.

The data indicated that while the recovery in the U.S. remains uneven, the economic outlook is continuing to improve.

The dollar has strengthened broadly since the Fed announced its decision in December to scale back its asset purchase program, cutting it by USD10 million, to USD75 billion-per-month. The central bank is scheduled to meet January 28-29 to review the economy and assess policy.

The CFTC Commitments of Traders report for the week ending January 14 showed that gross long New Zealand dollar positions increased by 2,736 contracts to 17,539, while gross short positions rose by 988 contracts to 7,925. Net longs totaled 9,614 contracts, compared to 7,866 in the previous week.

In the week ahead, investors will be closely watching Chinese data on gross domestic product, industrial production and retail sales. The Asian nation is New Zealand’s second largest trade partner.

In addition, New Zealand inflation data will be in focus, while U.S. data on jobless claims and home sales will also be closely watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets. The guide skips Tuesday and Friday as there are no relevant events on these days.

Monday, January 20

China is to release data on fourth quarter gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth. The country is also to produce data on fixed asset investment, industrial production and retail sales.

Markets in the U.S. are to remain closed for the Martin Luther King Day holiday.

New Zealand is to release data on consumer price inflation, which accounts for the majority of overall inflation.

Wednesday, January 22

New Zealand is to release private sector data on manufacturing activity.

Thursday, January 23

China is to release the preliminary estimate of the HSBC manufacturing index, a leading indicator of economic health.

The U.S. is release the weekly report on initial jobless claims and a private sector report on existing home sales.