Investing.com - The dollar pulled back from 15-month lows against the yen on Thursday after the Japanese currency’s strong gains so far this week prompted speculation that officials may soon intervene to stem the appreciation of the yen.

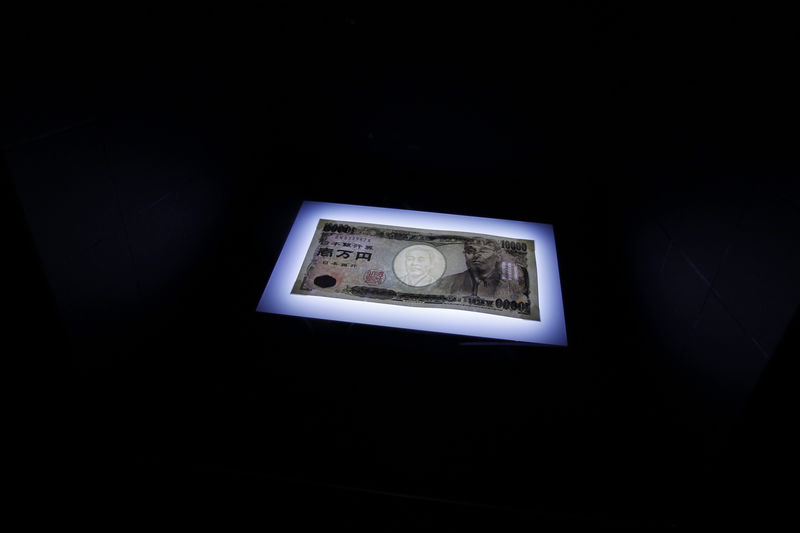

USD/JPY fell to early lows of 111.00, the weakest level since October 2014, before pulling back to 112.33, off 0.88% for the day.

The dollar weakened broadly after Federal Reserve Chair Janet Yellen indicated Wednesday that further U.S. rate hikes could be delayed.

Yellen, in testimony before a congressional committee, said there are good reasons to believe the U.S. will stay on a path of moderate growth that will allow the Fed to pursue "gradual" adjustments to monetary policy.

But she also acknowledged risks facing the U.S. economy from tightening financial conditions driven by falling stock prices and uncertainty over China.

The dollar’s steep drop against the yen was exacerbated by thin trading conditions, with markets in Japan and China closed for public holidays.

The dollar has fallen sharply from the six-week high of 121.68 reached against the yen on January 29, in the wake of the Bank of Japan’s shock decision to adopt negative interest rates.

With the yen on track to rack up its strongest weekly gains since the onset of the 2008 financial crisis speculation mounted that Tokyo will soon step in to stem inflows into the safe haven currency.

The euro also retreated against the yen, with EUR/JPY last at 127.48, off 0.39% for the day after falling to two-and-a-half years lows of 125.81 earlier.

The euro remained higher against the dollar, with EUR/USD up 0.61% at 1.1360, the most since October 21.

The greenback was at three-and-a-half month lows against a basket of the other major currencies.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, hit lows of 95.40, the weakest since October 22 and was last at 95.54.