(Bloomberg) -- The U.S. central bank should consider holding off on raising interest rates until inflation is above its 2% target, Philadelphia Fed President Patrick Harker said.

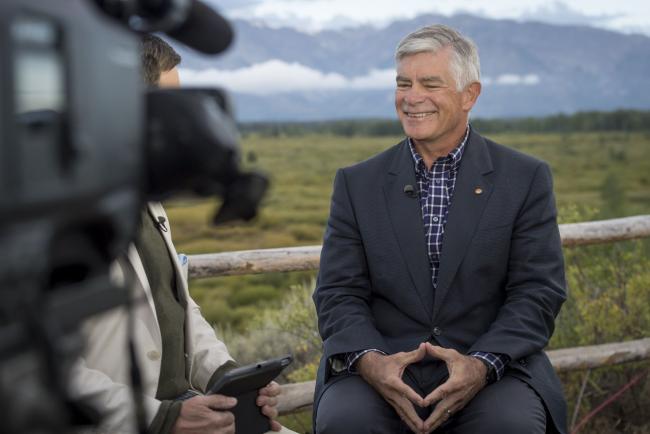

“We’ve been saying for a long time that the 2% inflation goal is symmetric, which means we should overshoot it. We were having a difficult time doing that, like all developed economies,” Harker said Wednesday during a Bloomberg Television interview with Michael McKee. “I’m supportive of the idea of letting inflation get above 2% before we take any action with respect to the fed funds rate.”

Fed officials left rates near zero at their meeting last month and signaled they would probably keep them there through 2022, according to their quarterly forecasts. The rate-setting Federal Open Market Committee, which Harker votes on this year, next gathers July 28-29.

Outlook Darkening

The Philadelphia Fed chief said his bank was in the process of revising its forecasts for the economy given the resurgence of coronavirus cases in the country’s South and Southwest regions, and warned that a failure to extend enhanced unemployment insurance benefits when they expire at the end of month would further worsen the situation.

“There are things I worry about. One is a cliff effect of unemployment insurance,” Harker said. “Yes, there is a need to get people back to work -- and people want to go back to work. But we can’t just cut it off, because if we cut it off, people will stop spending and that will be a hit on the economy.”

The central bank has rolled out several emergency lending programs and ramped up asset purchases in recent months to foster trading in financial markets during the pandemic. Fed Governor Lael Brainard said Tuesday that it was time for monetary policy makers to discuss a longer-term strategy to support the economic recovery, including offering more specific guidance to the public about how long they would keep their benchmark overnight rate at zero.

“Forward guidance constitutes a vital way to provide the necessary accommodation,” Brainard said. “Refraining from liftoff until inflation reaches 2% could lead to some modest temporary overshooting, which would help offset the previous underperformance.”

(Updates with more Harker comments from fourth paragraph.)

©2020 Bloomberg L.P.