Investing.com - The U.S. dollar was mixed against its major counterparts on Thursday, as market players looked ahead to the conclusion of the Federal Reserve’s policy-setting meeting later in the day, amid hopes of further easing.

During U.S. morning trade, the dollar was modestly lower against the euro, with EUR/USD easing up 0.09% to 1.2910.

Market players eyed the outcome of the Fed’s two-day policy meeting later Thursday, amid growing speculation that the U.S. central bank may announce a third round of bond purchases, or quantitative easing, to boost sluggish growth in the world’s largest economy.

Data released earlier in the day showed that the number of individuals filing for initial jobless benefits in the week ending September 8 rose by 15,000 to a seasonally adjusted 382,000, compared to expectations for an increase of 3,000 to 370,000.

The previous week’s figure was revised up to 367,000 from a previously reported 365,000.

A separate report showed that producer prices in the U.S. rose by a seasonally adjusted 1.7% in August, compared to expectations for a 1.1% increase, after rising 0.3% in July.

The greenback was also lower against the pound, with GBP/USD adding 0.07% to trade at 1.6119.

Elsewhere, the greenback was lower against the yen, with USD/JPY slumping 0.53% to hit 77.66, but higher against the Swiss franc, with USD/CHF gaining 0.24% to trade at 0.9395.

Earlier in the day, Swiss National Bank kept its benchmark interest rate unchanged in September and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro.

Meanwhile, the greenback was mixed against its Canadian, Australian and New Zealand counterparts, with USD/CAD inching down 0.15% to 0.9747, AUD/USD falling 0.12% to 1.0452 and NZD/USD edging 0.34% higher to trade at 0.8240.

The Reserve Bank of New Zealand left the benchmark interest rate unchanged at a record low of 2.50%, in a widely expected move.

Commenting on the decision, RBNZ Chairman Allan Bollard said there was little need to raise borrowing costs until the second half of 2013 because of risks from the euro zone’s financial crisis and the outlook for New Zealand’s trading partners, including China.

The dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, was down 0.13%, trading at 79.77.

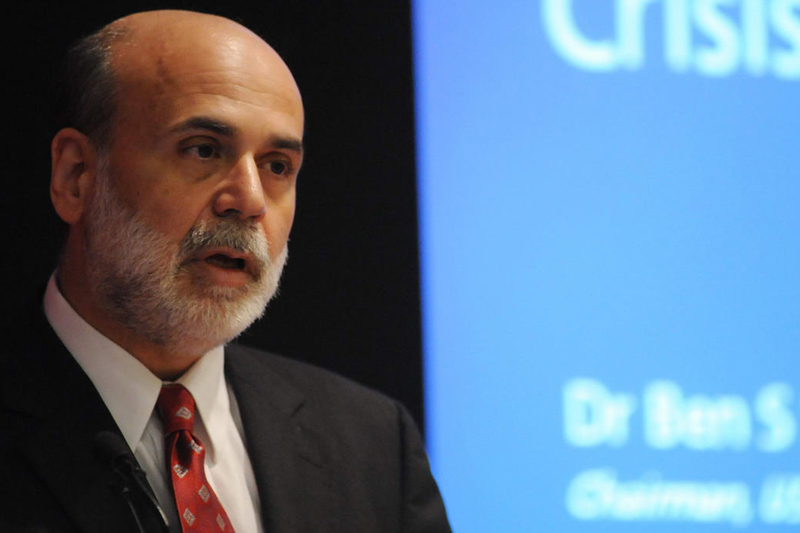

Later in the day, the Federal Reserve was to announce its benchmark interest rate, followed by comments by Chairman Ben Bernanke.

During U.S. morning trade, the dollar was modestly lower against the euro, with EUR/USD easing up 0.09% to 1.2910.

Market players eyed the outcome of the Fed’s two-day policy meeting later Thursday, amid growing speculation that the U.S. central bank may announce a third round of bond purchases, or quantitative easing, to boost sluggish growth in the world’s largest economy.

Data released earlier in the day showed that the number of individuals filing for initial jobless benefits in the week ending September 8 rose by 15,000 to a seasonally adjusted 382,000, compared to expectations for an increase of 3,000 to 370,000.

The previous week’s figure was revised up to 367,000 from a previously reported 365,000.

A separate report showed that producer prices in the U.S. rose by a seasonally adjusted 1.7% in August, compared to expectations for a 1.1% increase, after rising 0.3% in July.

The greenback was also lower against the pound, with GBP/USD adding 0.07% to trade at 1.6119.

Elsewhere, the greenback was lower against the yen, with USD/JPY slumping 0.53% to hit 77.66, but higher against the Swiss franc, with USD/CHF gaining 0.24% to trade at 0.9395.

Earlier in the day, Swiss National Bank kept its benchmark interest rate unchanged in September and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro.

Meanwhile, the greenback was mixed against its Canadian, Australian and New Zealand counterparts, with USD/CAD inching down 0.15% to 0.9747, AUD/USD falling 0.12% to 1.0452 and NZD/USD edging 0.34% higher to trade at 0.8240.

The Reserve Bank of New Zealand left the benchmark interest rate unchanged at a record low of 2.50%, in a widely expected move.

Commenting on the decision, RBNZ Chairman Allan Bollard said there was little need to raise borrowing costs until the second half of 2013 because of risks from the euro zone’s financial crisis and the outlook for New Zealand’s trading partners, including China.

The dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, was down 0.13%, trading at 79.77.

Later in the day, the Federal Reserve was to announce its benchmark interest rate, followed by comments by Chairman Ben Bernanke.