By Geoffrey Smith

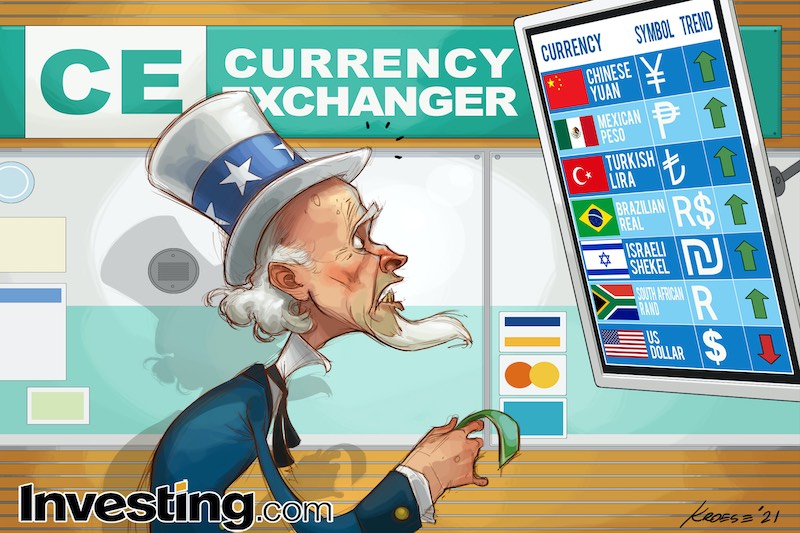

Investing.com -- For emerging markets, the new year has carried on much where the old one left off: a combination of loose global monetary policy and expectations of a vigorous rebound in global growth this year are creating the strongest tailwinds for the asset class in a decade.

Pretty much wherever you look, there is a bullish story to tell and, more often than not, it is the huge twin deficits of the U.S. that are ultimately responsible. With President-elect Joe Biden and his incoming administration about to create $1.9 trillion to sustain U.S. demand and Fed Chairman Jerome Powell just as focused on ensuring that financial conditions remain easy, it is hard to see a boat that won’t be lifted by the tide of dollars rushing out of the U.S. this year.

The reflationary policies enacted by Washington have already driven the Chinese yuan up over 5% from where it was a year ago, and that improvement in China’s spending power is sending strong ripples through global markets, as its increased commodity purchases recycle a trade surplus that is back at record levels, for all of Donald Trump’s efforts to cap it over the last four years.

“China is taking advantage of yuan appreciation to buy up stocks of wheat, corn...and probably copper and iron too...at prices that look relatively OK to them,” said Charlie Robertson, an economist with Renaissance Capital via Twitter on Monday.

Nickel and copper, the two metals that are powering the change to electric mobility more than any other, are up 30% and 27% over the last 12 months, respectively. Zinc and aluminum are also up by 10% in that timeframe - not bad considering it has witnessed the sharpest economic contraction in living memory. Coffee, sugar and cocoa have also all started to perform strongly in the last two months.

“The implication is China's surge in demand for these products will end when yuan appreciation stops,” says Robertson.

From Poland and Israel to Chile and Sweden, central banks have started intervening to stop their currencies appreciating too far, too fast. Israel’s bought $21 billion last year but couldn’t stop the shekel rising some 10% from the March low. It now intends to buy $30 billion to keep the shekel down this year.

Things are slightly different in Chile, where the central bank’s announcement of a $12 billion reserve accumulation program for this year is a response to the looming challenges of a 2021 calendar full of bond repayments and political risk events, including election in November.

Chile’s Latin American neighbors suffered grievous hits to their domestic economies from the pandemic last year, and with new strains of Covid-19 still raging in some regions, they will remain dependent to a large degree on external demand to recover this year. Robin Brooks, an economist with the Washington-based Institute for International Finance, says this may make the Mexican peso a better bet this year than the Brazilian real – even though he says the real is still “too cheap.”

“This is mostly about proximity to stimulus,” he argued, pointing to the fact that after the 2009 crisis, the real recovered faster because it was China, the great commodity importer, which opened the stimulus taps the widest. “In 2020 it's the reverse: now, the U.S. is doing a huge debt stimulus, which helps Mexico.”

However, nothing underpins an emerging currency like good old-fashioned economic orthodoxy, and on this score, risk-friendly investors can hardly ignore Turkey. Last year, the country abandoned a highly inflationary policy stance, with President Recep Tayyip Erdogan finally allowing his central bank (under new leadership) to raise interest rates sharply and ending its reliance on accounting sleights of hand to create an illusion of currency stability.

From a high of over 8.59 to the dollar at the depths of last year’s crisis, the lira has rallied to 7.45 as of this week. Although notoriously dependent on imports of vital commodities such as oil, Turkey is well positioned to benefit from the rollout of vaccines, given its status as a popular holiday destination with Europeans and Russians, while its customs union with the EU gives it good exposure to any rebound in the economy there as its 750 billion-euro recovery fund starts to be deployed.