By David Lawder

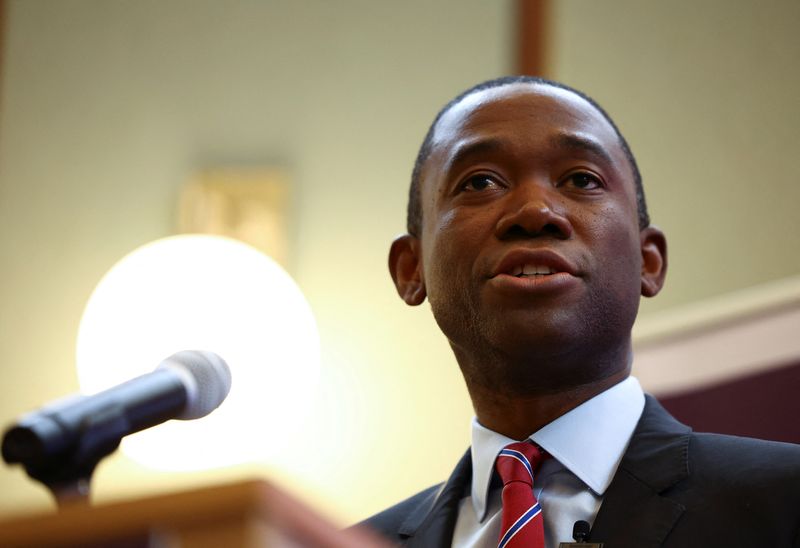

(Reuters) -U.S. Deputy Treasury Secretary Wally Adeyemo said on Friday that he is concerned about China's excess manufacturing capacity spilling over to the global economy, even if China's current economic woes are unlikely to slow U.S. growth in the near term.

"I am not concerned about the headwinds from China having a large impact on the US economy," Adeyemo told a Council on Foreign Relations event in New York, referring to challenges from its property sector, an aging population and a worsening business climate for private firms.

"The thing that I am fundamentally concerned about from China is excess capacity coming from China and hitting the global economy," Adeyemo said.

China's heavily subsidized manufacturing capacity for electric vehicles, solar panels and other goods has followed industries such as steel and aluminum in producing more goods than China can consume, he added.

"Fundamentally that overcapacity is going to go somewhere," Adeyemo said, adding that U.S. tariffs and tax credits for EVs and their batteries will help keep Chinese EVs out of the U.S. market and allow American firms to compete more fairly.

"This is going to be a challenge for the global economy and it's something we are talking directly with the Chinese about," Adeyemo said. "They need to compete on a level playing field, not just with the United States, but with countries around the world."

U.S. Treasury Secretary Janet Yellen is expected to raise her concerns about Chinese excess capacity with counterparts on the sidelines of a Group of 20 finance ministers meeting in Sao Paulo, Brazil, next week, a senior Biden administration official said.

DOLLAR DOMINANCE

Adeyemo, who presented a new round of U.S. sanctions on over 500 Russian-linked targets a day before the second anniversary of Russia's invasion of Ukraine, downplayed the potential for damage to the dollar's status as the world's reserve currency from such measures. He said it was important that sanctions be multilateral and targeted to maximize their effectiveness.

"Fundamentally, my view about this question of whether the use of sanctions is going to lead to some challenges to the dollar, is that the thing that's going to matter to the dollar's role in the global economy isn't the strength of our economy."

He said Biden administration policies, including investments in infrastructure, semiconductors and clean energy technologies, have made the U.S. a more attractive investment destination.

"As long as we are able to continue to do that, I feel good about the fact that the dollar, America's financial system, is going to remain dominant in the world," Adeyemo said.