By Leon Pick

You got the feeling that it was only a matter of time.

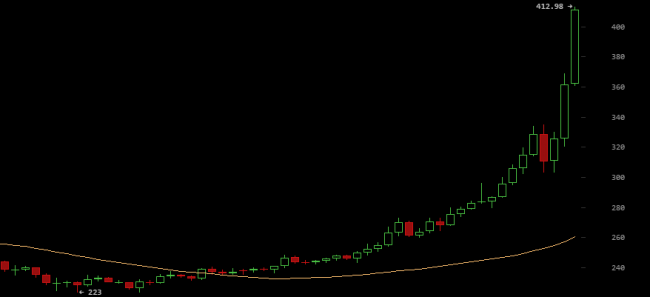

Bitcoin (BTC/USD) just broke through $400 on Bitstamp for the first time in nearly a year, a new milestone in its biggest rally in 18 months.

Bitcoin hit $300 only a week ago. In highly November 2013-esque fashion, it has taken on a life of its own, casting aside its steady climb and soaring by another 13% during the past 24 hours to $413.

The pace of bitcoin's rise accelerated noticeably yesterday, when it gained over 10% within a 5-hour span.

Traders have come to the point of driving the price higher knowing full well that the next one will do the same.

Bitcoin has now more than doubled since falling below $200 in late August.

Chinese exchanges like Huobi already breached $400 a few hours earlier. The USD equivalent on Huobi hit $425, about 5% ahead of Bitstamp, and further suggesting that this party is being led by Chinese traders.

Prices on BTC-e are roughly 5% below those on Bitstamp and 10% below those on Huobi, a slightly lower gap than yesterday but still an unsettling phenomenon for one of the largest USD exchanges.

Bitcoin is now a whopping 54% above its 50-day moving average (MA), its biggest differential since the great bubble of November 2013.

Shares of Bitcoin Investment Trust (OTCMKTS:GBTC) opened the day at $49.00, their highest level since shortly after launching for public trade in May, and implying a 31% premium to their underlying bitcoin value. The shares are now trading at $47.00, or a 23% premium.

One can assume that a big correction is in order, the question now being how high bitcoin will go first.