(Bloomberg Opinion) -- The euro’s steady deterioration is the European Central Bank’s saving grace. It buys policy makers more time to assess how dovish it needs to be — but they need to be careful not to fritter away this asset.

The euro-area economy is decelerating rapidly, and it is the export-led nations that are suffering most. Keeping the currency from approaching the 1.25 level to the dollar, as it did last year, is vital if there is to be any sustained recovery. The slowdown over the past year can be parked at the foot of the overly strong currency during 2017 and the first half of 2018. It figures, therefore, that expectations the ECB will indeed extend stimulus are keeping the currency down.

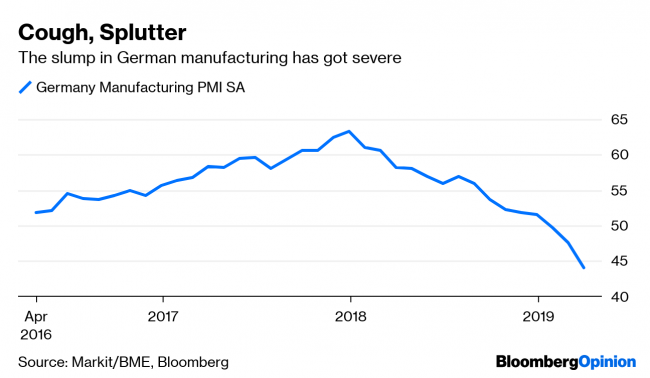

By June euro-area rates will have been negative for five years, but it is hard to see real benefits. Core inflation has ticked down again to just 0.8 percent — well away from the ECB target of below but close to 2 percent. The Italian government is expected to lower growth estimates for 2019 to just 0.1 percent. German manufacturing PMI sank to 44.1 in March, leading the nation’s five leading research institutes to slash their 2019 growth forecast to 0.8 from 1.9 percent.

The ECB never managed to restore any sort of normalcy to its monetary policy after the trauma of the recent decade. It doesn’t have a lot of room to make changes to help an ailing economy. A weak euro does some of this work for them, so the bank needs to recognize that the best help it can give itself is keeping the tailwind of a nice, steady soft currency at its back.

However, President Mario Draghi will have some explaining to do at the press conference on April 10. He said on March 27 that the ECB should evaluate new measures that can preserve the benefits of negative rates, while mitigating the side effects. This was taken by the markets as a new dovish turn, which drove the euro close to a two-year low.

His colleagues are not exactly all on board. Such a move raises the specter of tiering deposit rates, something that’s not an easy sell. The day after Draghi spoke, outgoing Chief Economist Peter Praet pushed back, saying there needed to be a solid monetary policy case for any changes. And Dutch central bank President Klaas Knot said the ECB should “stay far away.” As usual there is an internal battle underway with the hawks not wanting to be bounced into another easing of policy. The dispute here is in danger of ruining the mood music that’s keeping the currency at a level which can keep economies from sliding into a recession.

The disagreements could also break out on another front. To avoid a credit crunch, the ECB needs to implement a replacement for targeted long term refinancing operations that will soon expire. If tiering is difficult, imagine linking TLTROs (which benefit mostly weaker banks) to any increase in the deposit rate (more closely linked to profitability of stronger German, French and Dutch banks). That could create a real war of words — further jeopardizing the euro.

The last thing Europe needs is a serious policy fracture. That Draghi will step down in six months and his replacement has not been named only adds to the fragility of communications coming out of Frankfurt. Hopefully officials will take care with this gift they’ve been given.