Investing.com’s stocks of the week

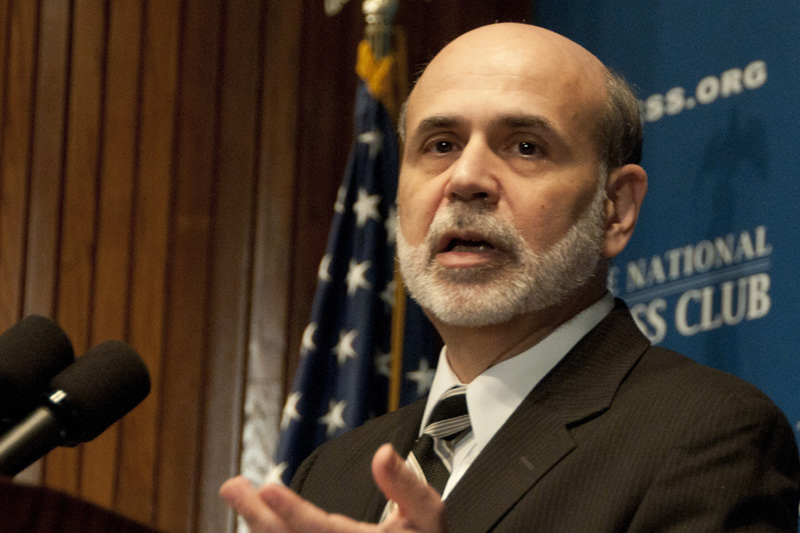

Investing.com - Federal Reserve Chairman Ben Bernanke reiterated the bank’s commitment to highly accommodative monetary policy on Tuesday, and reaffirmed his view that the bank’s stimulus program is working.

In a speech to the National Economists Club in Washington, Bernanke said the USD85 billion-a-month asset purchase program will continue to depend on the state of the economy and was not on a preset course.

Bernanke said the Fed would only start pulling back its stimulus program when it was assured of a durable recovery in the labor market. He specified for the first time other labor market indicators that policymakers may consider, including job growth, labor force participation and hiring rates.

Interest rates will probably remain near zero for a “considerable time” after the bank winds up the stimulus program, he added.

"I agree with the sentiment, expressed by my colleague Janet Yellen at her testimony last week, that the surest path to a more normal approach to monetary policy is to do all we can today to promote a more robust recovery," he said.

Ms. Yellen, the Fed's current vice chairwoman, has been nominated by President Barack Obama to take over from Ben Bernanke when his term finishes at the end of January. The Senate Banking Committee, which held a confirmation hearing for Ms. Yellen last week, is to vote on her nomination on Thursday.

Bernanke also acknowledged the importance of increased transparency and better communications in delivering monetary policy.

"In response to a financial crisis and a deep recession, the Fed's monetary policy communications have proved far more important and have evolved in different ways than I would have envisioned eight years ago," he said. “Policy transparency remains an essential element of the Federal Reserve’s strategy for meeting its economic objectives.”

The Fed is to hold its next monthly policy meeting on December 17-18, but many economists believe the bank will not announce any changes to the scale of the easing program until early next year.

In a speech to the National Economists Club in Washington, Bernanke said the USD85 billion-a-month asset purchase program will continue to depend on the state of the economy and was not on a preset course.

Bernanke said the Fed would only start pulling back its stimulus program when it was assured of a durable recovery in the labor market. He specified for the first time other labor market indicators that policymakers may consider, including job growth, labor force participation and hiring rates.

Interest rates will probably remain near zero for a “considerable time” after the bank winds up the stimulus program, he added.

"I agree with the sentiment, expressed by my colleague Janet Yellen at her testimony last week, that the surest path to a more normal approach to monetary policy is to do all we can today to promote a more robust recovery," he said.

Ms. Yellen, the Fed's current vice chairwoman, has been nominated by President Barack Obama to take over from Ben Bernanke when his term finishes at the end of January. The Senate Banking Committee, which held a confirmation hearing for Ms. Yellen last week, is to vote on her nomination on Thursday.

Bernanke also acknowledged the importance of increased transparency and better communications in delivering monetary policy.

"In response to a financial crisis and a deep recession, the Fed's monetary policy communications have proved far more important and have evolved in different ways than I would have envisioned eight years ago," he said. “Policy transparency remains an essential element of the Federal Reserve’s strategy for meeting its economic objectives.”

The Fed is to hold its next monthly policy meeting on December 17-18, but many economists believe the bank will not announce any changes to the scale of the easing program until early next year.