Investing.com -- While much of the world is welcoming signs of cooling in inflation following an historic bout of sky-high price gains, China is facing mounting fears that it could be entering a period of entrenched deflation.

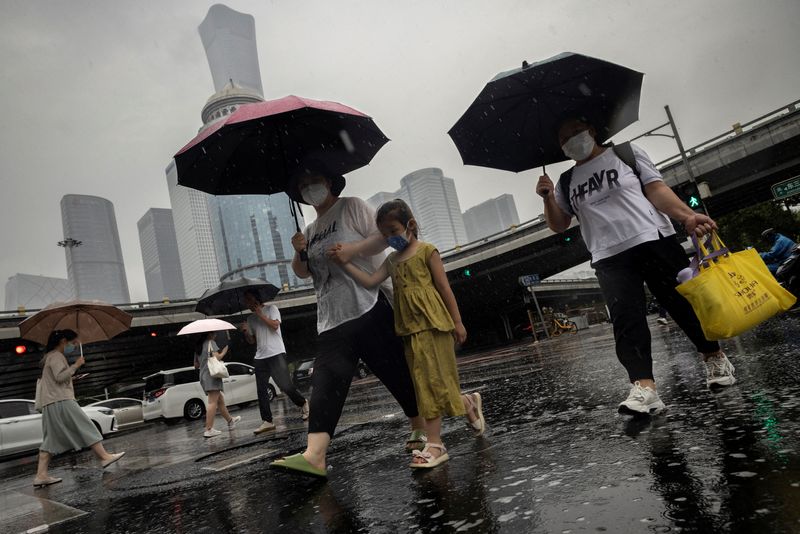

In August, consumer price inflation in China hit its fastest pace in half a year, but the data did little to assuage concerns over the state of demand in the world's second-largest economy. Much of this was due to the fact that food prices -- the main driver of the 0.6% uptick in China's consumer price index compared to a year earlier -- were bolstered mainly by inclement summer weather, rather than a more sustainable rebound in domestic demand.

Core consumer inflation, stripping out items like food and fuel, came in at 0.3% in August, slowing from 0.4% in July. It was the lowest reading in almost three and a half years.

At the same time, producer prices shrank by 1.8% year-on-year, accelerating from a decline of 0.8% in the prior month.

Prolonged deflation presents a potential danger to the economic outlook, analysts at Morgan Stanley warned, adding that paycheck sizes in particular could see declines. Such a trend threaten to initiate a domino effect of declining spending, lower corporate revenues, and subsequent layoffs.

In the 1990s, Japan entered into a similar stretch of deflation that sparked what has since become known as its "lost decades" -- or a time of economic stagnation following the peak of the country's meteoric post-World War II rise in the 1980s.

"[A]s decades in Japan ha[ve] shown, deflation can lead to a cycle that becomes ever more difficult to break," the Morgan Stanley analysts said in a note to clients.

To avoid a similar fate, economists have argued that China's government may need to roll out sweeping -- and potentially expensive -- measures to stem the deflationary cycle.

Beijing has already attempted to reinvigorate the economy by putting loans into the industrial sector, although the aid for these firms has increased the supply of consumer goods without boosting overall demand, further fueling deflation.

"Consequently, the short-run boost to employment, income, and thus domestic spending has been very limited," the Morgan Stanley analysts said.

At the moment, China has laid out a plan to hit 5% in real gross domestic product growth in 2024. But the deflationary pressures could threaten that goal, economists have said.

Lawmakers may start to mull over providing fiscal support to housing and social welfare programs, the Morgan Stanley analysts predicted, saying these moves could shore up China's "critical" real estate sector and bolster savings.

However, they warned: "Despite the early signs of some shift in tone from Beijing, it is hard to imagine a meaningful change in direction for policy and subsequently the economy any time soon."

The ongoing battle with contracting prices is not confined to China alone, the analysts added, flagging that, from its position as one of the world's key trading destinations, the country "continues to export disinflationary pressure globally."

They noted that China's deflationary cycle has so far dented core inflation in both the US and eurozone by around 0.1 percentage point, adding that this a "meaningful" as central banks in both of the regions are beginning to embark on a fresh cycle of interest rate reductions.