By Andrea Shalal

WASHINGTON (Reuters) -The White House on Tuesday said it is closely tracking developments in commercial real estate after recent strains in the banking sector, given that many smaller and mid-sized banks have "non-trivial" holdings in commercial real estate.

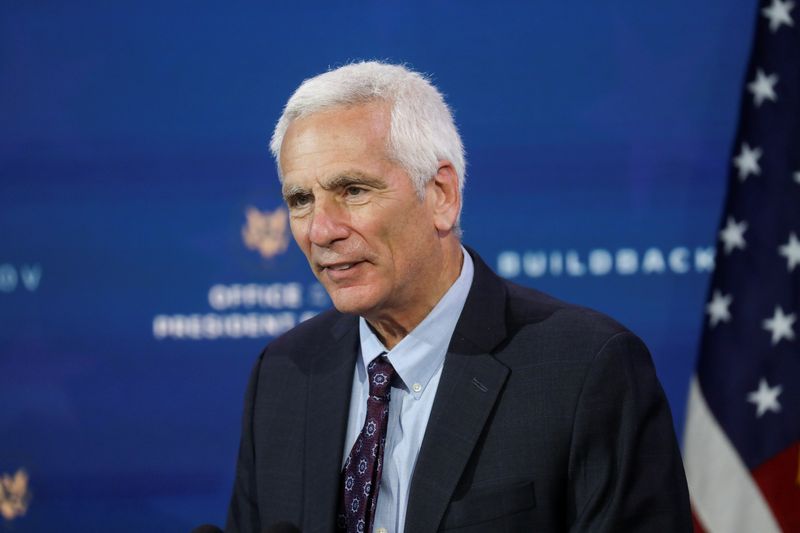

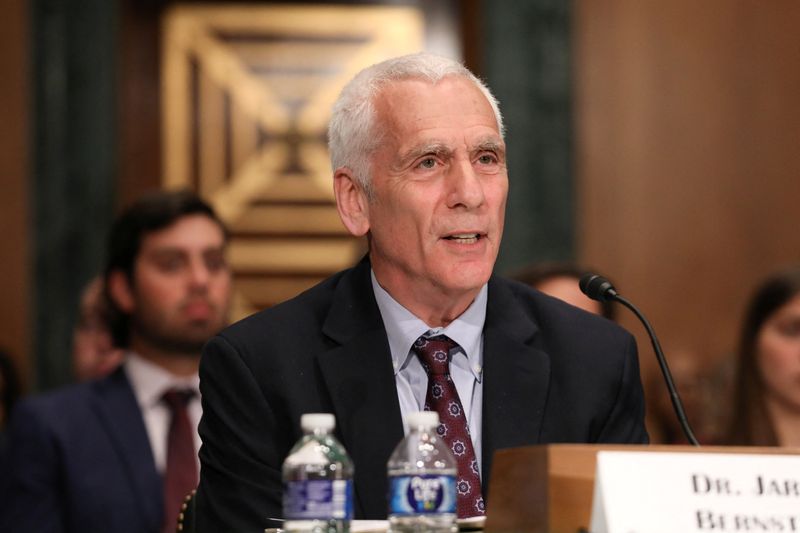

Jared Bernstein, a member of the White House Council of Economic Advisers (CEA), told a Senate Banking Committee hearing that occupancy rates in commercial real estate were well below pre-COVID levels and delinquencies had risen a bit recently, although they remained low in historical terms.

"The issue is very much on our watchlist," Bernstein said during a hearing on his nomination to head CEA, when asked by Democratic Senator Mark Warner about the impact of the collapse of Silicon Valley Bank (SVB) on the sector. The previous CEA chair, Cecilia Rouse, last month returned to her job at Princeton University.

Warner noted that close to $6 trillion in outstanding commercial debt was related to the real estate market, and a "massive dislocation" was under way.

"That is a relevant, germane concern," Bernstein said, adding that federal actions to stabilize the banking system after the failure of SVB and Signature Bank (OTC:SBNY) helped ameliorate the stressors, but it was worth keeping an eye on the situation.

On the issue of inflation, Bernstein conceded that the Biden administration's use of the word "transitory" had not been helpful and had left open questions of how quickly inflation could be expected to start easing.

He said inflation was falling much faster in the United States now than in Britain or the European Union, and core goods prices had been negative or flat for the past six months.

Still, he conceded that inflation had lasted longer than when the term "transitory" was first used.

"The word is not a helpful term. It's too ambiguous," he said.