By Geoffrey Smith

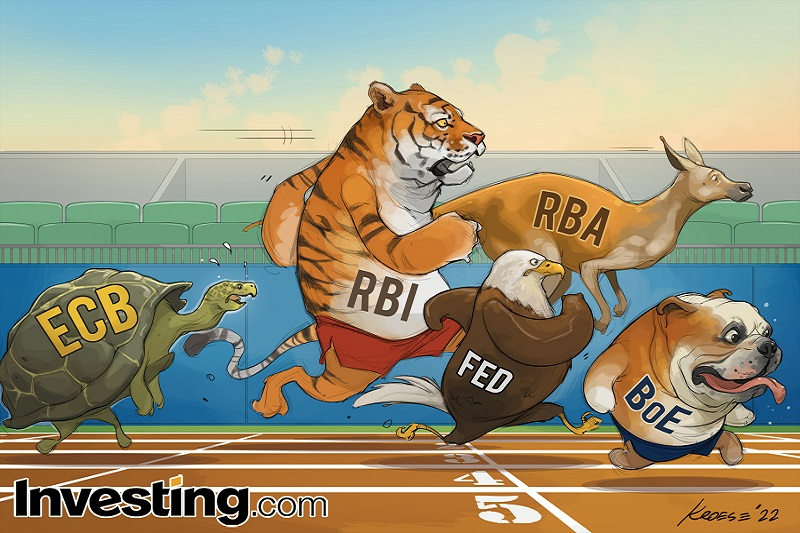

Investing.com -- An unmistakeable sense of urgency has overtaken the world’s central banks.

Having soft-pedalled through 2021 despite ever clearer signs that inflation was taking off, they are now in a hurry from Washington to Wellington to bring the world’s worst outbreak in 45 years under control.

The U.S. Federal Reserve has signalled that it will “discuss” half-point increases in interest rates at its next two meetings, after a first half-point raise in over 20 years. The market took Chair Jerome Powell’s words to mean that this is now the base case scenario for the next quarter.

The Reserve Bank of Australia raised its cash rate for the first time in 12 years, by 25 basis points to 0.35%, and signalled that more was to come in short order. Like the Fed, the RBA is also starting to let the pile of bonds they have bought in the last few years mature, draining excess liquidity from their respective financial markets.

Emerging market central banks, which responded to the threat of inflation much sooner, are still hiking aggressively: Brazil hiked by another full percentage point on the same day as the Fed, taking its key rate to 12.75%. Only five policy meetings ago, that had stood at 6.25%.

Chile, beset by a wave of strikes by workers demanding their share of the windfall in copper prices, raised by 125 basis points to 8,25%, while in Europe, the Czech and Polish National Banks hiked by 75 basis points each – more than expected from the Czechs and less than expected from the Poles.

Never in the field of monetary policy, it would see, have so many central banks been in such a hurry to raise rates so quickly.

But there is a catch. The economy is already slowing, especially in Europe, due to Russia’s war in Ukraine. The war has sent consumer and business confidence plunging and oil prices skyrocketing, even though the EU’s inability to form a common line still means Russian oil and gas can flow to market easily enough.

Both the European Central Bank and the Bank of England are visibly afraid of raising interest rates and putting the brakes on the economy just as the market provides its own corrective. The Bank of England raised its key rate by a quarter point last week even though it simultaneously cut its growth forecasts – it now expects contraction by the end of this year. Even Michael Saunders, the Bank’s most hawkish policy-maker, styled his push for a half-point rate hike as an effort to avoid the even more unpalatable choice of tightening later when the slowdown is more advanced.

The Eurozone economy is likewise slowing sharply. The window for interest rate rises by the European Central Bank is narrowing by the day: wait much longer and the economy will already be in recession. No wonder that most of the bank’s board has now swung solidly behind a rate hike in July, the first since the ill-judged tightening of 2011 that triggered the euro crisis. Now, as then, the ECB would be hiking into a slowing economy.

Then, as now, markets are reacting by selling the bonds of Italy and Greece much more quickly than those of other member states. The ‘spread’ between the Italian and German 10-year yields, a rough proxy of financial stress within the Eurozone, is at its highest in over two years.

Wider bond spreads mean, for all practical purposes, that the Eurozone no longer has a single monetary policy, since it is national government bonds that form the benchmark for local credit markets.

If 2011 is any guide, wider bond spreads will also embolden speculation that not everyone in the Eurozone can afford to be in the Eurozone. That is why some ECB officials are already talking of the need to keep buying bonds from the region’s notorious ‘periphery’ – even as the bank hikes rates to bring down inflation.

For most economists, that is a circle that cannot be squared.

“The moment of truth for the ECB is rapidly approaching,” Robin Brooks, an economist with the International Institute for Finance, said via Twitter on Monday. “You can't hike policy rates - a tightening - and simultaneously keep QE going - a loosening - because you're worried about periphery spreads.”

Faced with a stark choice, Brooks argued the ECB should err on the side of being too loose rather than too tight.

“If the Eurozone goes into recession, that makes second-round effects much less likely, which means inflation won’t generalize the way it would in a strong economy,” he said. “That allows the ECB to sit this one out.”