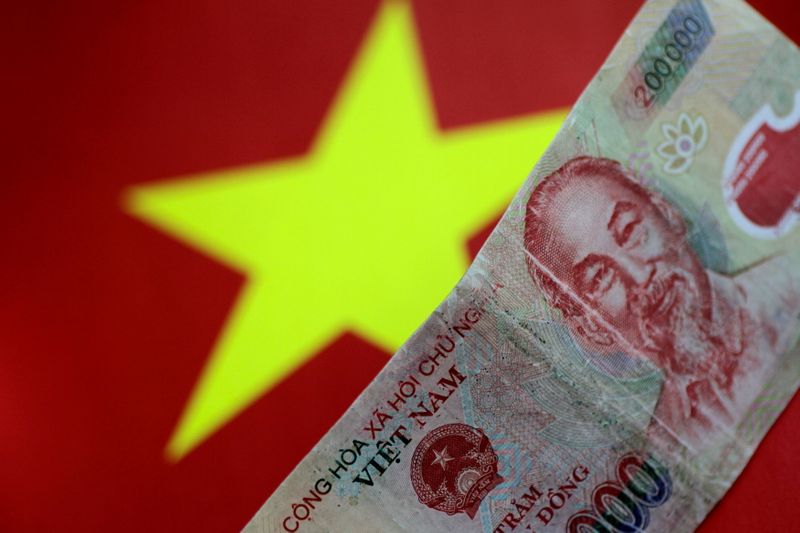

HANOI (Reuters) - Vietnam will pay more attention to its monetary policy as it is not only a domestic matter but a concern for the country's big trade partners, a central bank deputy governor said on Sunday, days after the U.S. Treasury's semi-annual currency report.

The U.S. Treasury report on Friday said that Vietnam exceeded its trade surplus, current account and foreign exchange intervention thresholds, but was "satisfied with progress made by Vietnam to date" on addressing exchange-rate issues.

Speaking at an economic forum, Pham Thanh Ha, deputy central bank governor, said the bank had taken the issues seriously and its monetary policy towards them had been implemented effectively.

"We have to pay more attention to our monetary policy implementation as it does not have impact on our domestic economy but our big trade partners as well," Ha said.

"Vietnam will keep implementing monetary policy in a cautious and flexible manner."

Ha also said the central bank bought about $25 billion worth of dollars over the past two years to help inject dong into the banking system and boost the economy.

If necessary, he said, the bank would have to implement measures that would affect liquidity and market interest rates amid rising inflation risks.

(This story has been corrected to delete extraneous word "the" in the first paragraph, add missing word "bank" in paragraph 6)