By Fergal Smith

(Reuters) -Canada's main stock index edged lower on Friday but still notched its fourth straight weekly gain as bigger-than-expected U.S. and Canadian jobs gains bolstered prospects of a soft economic landing.

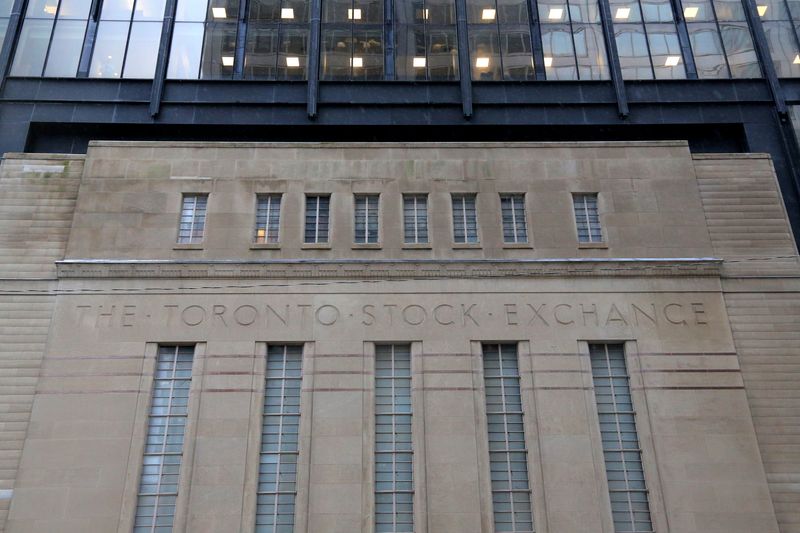

The Toronto Stock Exchange's S&P/TSX composite index ended down 57.03 points, or 0.3%, at 21,737.53, after posting on Thursday its highest closing level in nearly two years.

For the week, the index was up 0.9%. The weekly winning steak was the longest since April 2023.

"The U.S. still seems very much on course for a soft landing. In Canada, it's a little bit more nuanced I think, but by all indications the market is holding up relatively well," said Elvis Picardo, a portfolio manager at Luft Financial, iA Private Wealth.

U.S. job growth accelerated in February, but that likely masks underlying softening labor market conditions as the unemployment rate increased to a two-year high of 3.9%.

Canada's economy added 40,700 jobs in February, double the expected gain but and wage growth slowed for a second consecutive month as the central bank continues to hold interest rates at a 22-year high.

The energy sector fell 0.7% as oil settled 1.2% lower at $78.01 a barrel and shares of uranium miners declined. Nexgen Energy Ltd lost 8.7% and Cameco Corp (TSX:CCO) was down 6.2%.

Consumer-related stocks also lost ground, with the consumer staples sector falling 1% and consumer discretionary ending 0.4% lower.

The materials index which includes precious and base metals miners and fertilizer companies, edged up 0.2% as gold added to its record-setting rally.

"Despite gold being at an all-time high, despite the geopolitical uncertainty, the resource sector which is a big driver hasn't really taken off. That's impeding the TSX's progress a little bit," Picardo said.