By Michele Sinner and Marcin Goclowski

LUXEMBOURG/WARSAW (Reuters) - The European Union's (EU) top court ruled on Thursday in favor of Polish consumers who took out mortgages in Swiss Francs, allowing them to ask Polish courts to convert the loans into the local zloty currency in a blow for lenders.

Changing the terms of the loans, which had become prohibitively expensive after the Swiss franc jumped in value, means Polish banks will have to refund some customers.

The verdict was not an outright victory for borrowers, however, because it will be up to Polish courts to decide on a case-by-case basis how the contracts are altered.

"The ruling is a bit vague, leaves space for interpretation, which means that the risk for banks is a bit smaller than expected," said Michal Sobolewski, an analyst with BOS brokerage.

An index of Polish banking stocks (BNKI) was down 0.8 percent at 1343 GMT, with PKO BP (WA:PKO), the country's largest bank, down 0.8%.

"The potential consequences of the ruling will be spread over time," Poland's second-largest lender Santander Bank Polska (MC:SAN) said in a statement.

France's BNP Paribas (PA:BNPP), Germany's Commerzbank (DE:CBKG) and Portugal's BCP (LS:BCP) all have foreign-exchange denominated mortgage portfolios in Poland.

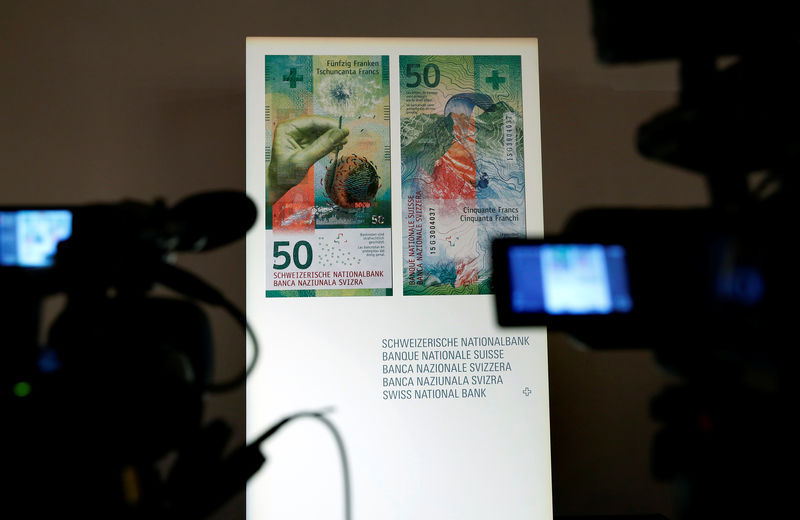

Attracted by lower interest rates some 700,000 Poles took out mortgages in foreign currencies, mainly in Swiss francs, nearly a decade ago. They are now paying far bigger instalments than they expected after the Swiss franc soared 92 percent against the zloty since the start of the global financial crisis in 2008.

Foreign currency loans total 124 billion zloty ($31 billion), almost one third of all Polish mortgages, and Thursday's court verdict is expected to encourage more borrowers to sue for refunds.

Currently there are more than 11,000 cases running in the courts. In the first half of 2019 the number of lawsuits jumped 39% to 2,021, as the fee for triggering cases was slashed.

Poland's bank lobby group, ZBP, said on Wednesday that the verdict would likely cost banks less than their previously expected estimate of at least 60 billion zloty ($15.13 billion)spread out over a number of years.

"We believe that because of the ECJ ruling courts will not absurdly favor consumers that have foreign currency mortgages," Zdzislaw Pietraszkiewicz, ZBP's president, told a news conference.

The ECJ verdict is non-binding, but can be considered a guideline for local courts. Typically, the Polish courts need several years to conduct the case and the ruling depends on the particular judge, so consumers can not take for granted that they will win on the grounds of the ECJ's verdict.

DIFFERENT SOLUTIONS

FX loans have been an issue in other central European countries, but different countries have taken different approaches to dealing with them.

In Hungary, Viktor Orban's government in late 2014 eliminated billions of euros worth of such mortgages, penalizing banks heavily. The loans were converted into Hungarian forint. The central bank supported lenders with FX reserves.

Poland's ruling nationalist Law and Justice (PiS) party ruled out state help for borrowers in 2017 saying instead that debtors should ask the courts for help. Some poor borrowers are, however, eligible for support from a special dedicated fund.

In Croatia, thanks to legal changes in 2015, most foreign currency denominated loans were converted into euros, at the expense of the banks.

A recent ruling by Croatia's Supreme Court means these borrowers can individually sue banks for compensation, although the lenders are trying to reverse that ruling in the Croatian Constitutional Court and EU courts.

In Slovenia, several cases are going through the courts, with some ruling in favor of the banks, while others have backed the borrowers. The majority of cases have not been finalised, however, as most can appeal to a higher court.

Polish banks are regarded as well capitalized as they must conform to strict local capital requirements. Analysts say the banks can brace for future losses by cutting back on dividends or on lending.

Since the ECJ issued an opinion in mid-May signaling the direction of Thursday's ruling, banks with the biggest Swiss franc-denominated mortgages portfolios lost 11-38% in value.