BANGKOK (Reuters) -Thailand's central bank has been in the foreign exchange market to reduce currency volatility, the central bank said on Saturday, as the Thai baht currency hovered at 16-year lows against the dollar.

The baht has fallen 11.7% against the dollar this year, which the central bank said had been driven by dollar strength.

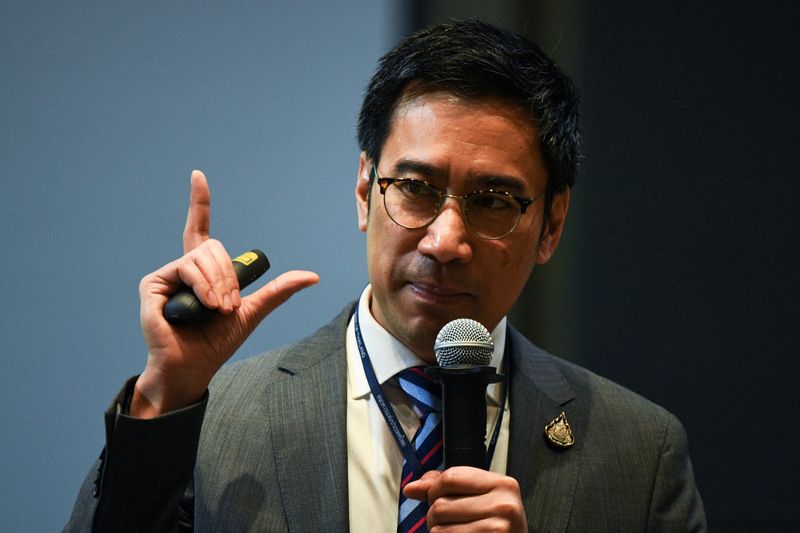

However, the weighted baht index against other currencies has been stable, while the country's external position and banking system remained strong, Deputy Bank of Thailand Governor Mathee Supapongse told reporters.

"We've entered the market sometimes to slow down volatility (in the baht)," he said, adding the BOT had no target for baht levels.

A fall in Thailand's international reserves was not because of currency intervention but rather asset valuations, he said.

Despite wide Thai-U.S. rate differentials, Thailand has attracted capital inflows, Mathee said.

Foreign investors have bought 150 billion baht ($3.97 billion) of Thai shares so far this year but sold 33 billion baht of bonds.

Governor Sethaput Suthiwartnarueput said gradual and measured policy tightening was suitable to support Thailand's still slow economic recovery, but he was ready to adjust if needed.

On Wednesday, the BOT raised its key interest rate by a quarter point to 1.00% to tame 14-year high inflation.

($1 = 37.77 baht)