By Satawasin Staporncharnchai and Chayut Setboonsarng

BANGKOK (Reuters) -Thailand's central bank chief said on Wednesday some of his opinions on the economy differed from those of new Prime Minister Srettha Thavisin, who has promised stimulus for an economy struggling with weak exports and tourism spending.

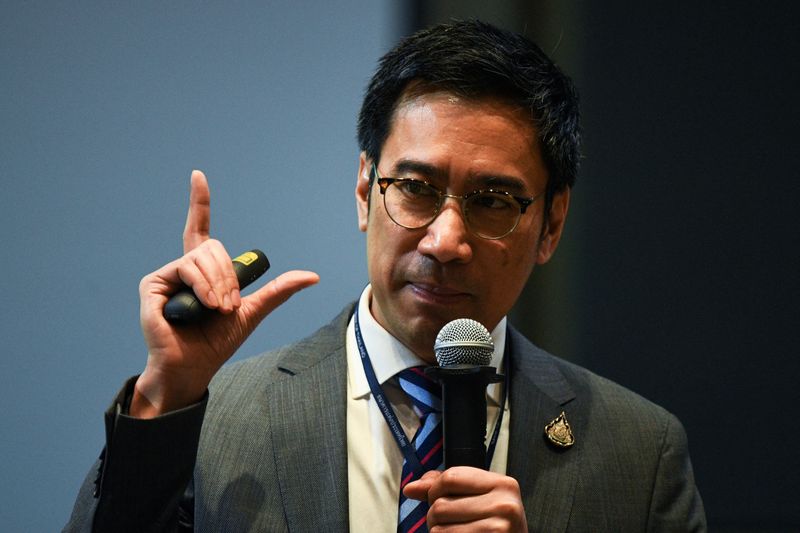

Bank of Thailand (BOT) Governor Sethaput Suthiwartnarueput's remarks came a week after the central bank unexpectedly raised key interest rates to 2.50%, the highest in 10 years, in a move that seemed to clash with the government's plan to inject 560 billion baht ($15.06 billion) into the economy through a digital wallet handout.

"We had some different opinions, but there is no conflict," Sethaput said, describing a meeting with the prime minister earlier this week after the surprise rate hike.

"We had a frank discussion and listened to each other," he told reporters on the sidelines of a business forum.

The BOT last week cut its 2023 gross domestic product (GDP) growth forecast to 2.8% from 3.6% projected earlier, though it lifted its 2024 projection to 4.4% from 3.8%. Last year, the economy grew by 2.6%.

Fiscal spending should be limited because it would impact the economy, Sethaput said at the business forum, instead urging an improvement in the ease of business and reducing regulations to draw more investment.

"The country's capacity for long-term growth needs to be examined," he said.

Thailand's economic recovery is intact and overall the financial system is stable enough to withstand external shocks Sethaput said, but he warned there were inflation risks from higher wages and food and energy prices as well as future government policies.

At the same forum later on Wednesday, Prime Minister Srettha said the digital wallet policy was a short-term measure and that he was urging foreign companies to invest in Thailand to boost growth.

"We have to build confidence to draw in more investors," he told business executives.

($1 = 37.1900 baht)