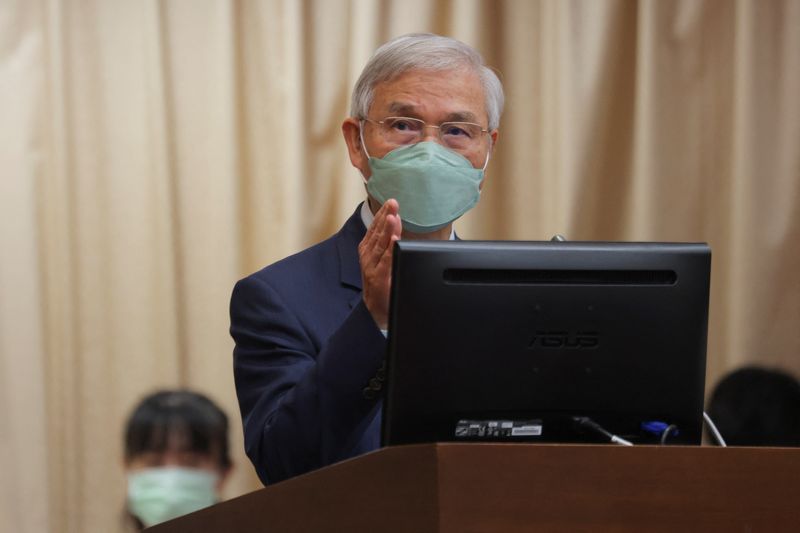

TAIPEI (Reuters) - Taiwan's inflation will slow to around 2% this year but the economy will not fall into stagflation even as growth slows, central bank governor Yang Chin-long said on Wednesday ahead of its next scheduled rate-setting meeting later this month.

The central bank, at its last quarterly meeting in December, raised its policy rate by 12.5 basis points (bps) to 1.75% and signalled an end to rate hikes in 2023 given inflation is coming under control.

Yang, reiterating his December comments that inflation in 2023 would drop back to below 2%, told lawmakers at a parliament session that the bank's monetary policy was "appropriate".

"Based on current forecasts, inflation is expected to fall to around 2% with GDP at 2%. This is basically acceptable," he said.

However, Taiwan's January consumer price index rose 3.04% year-on-year, exceeding market expectations for a 2.69% rise.

Yang said that in the first quarter inflation would remain higher, and start heading down from the second quarter.

"Prices of energy and commodities have fallen very quickly this year. The current forecast shows these prices are continuing to fall," he said.

With the economy now slowing sharply, having contacted 0.41% in the fourth quarter, the central bank will have to consider at its next scheduled quarterly meeting on March 23 whether to stand pat, or even to start cutting rates.

Yang said it was "not appropriate" to raise interest rates quickly, noting that the impact would be huge.