ZURICH (Reuters) - Swiss Finance Minister Ueli Maurer wants to use payouts from the Swiss National Bank exclusively to cut debt that will swell as the country ramps up borrowing to spur an economy hit hard by the coronavirus pandemic, he told a newspaper.

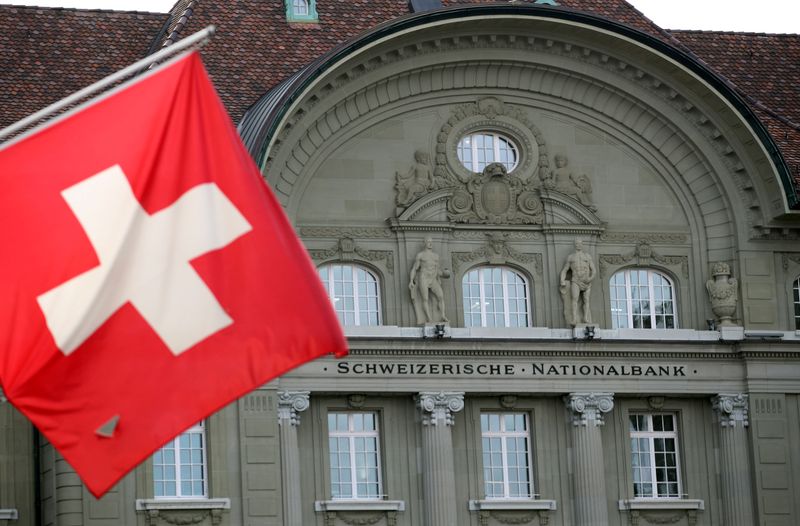

After the central bank posted an annual profit of 48.9 billion Swiss francs ($50.27 billion) for 2019, the SNB had said it would double its payout to Switzerland's regional and central governments to 4 billion francs.

Maurer said this payout could be used to pay down the government's debts, which he thinks may push the budget into a deficit this year as the virus triggers the worst Swiss recession in 45 years.

"My proposal is that in future we use all the SNB's distributions to reduce our corona debt," he told the Neue Zuercher Zeitung.

The SNB declined to comment.

The minister predicted Switzerland, which normally runs budget surpluses, could run a budget deficit of 30 to 50 billion francs this year as unemployment rises due to the crisis. There could also be additional costs from 40 billion francs in credit guarantees the government is making available to keep businesses afloat, Maurer said.

Government economists have forecast the Swiss economy could shrink by 6.7% this year, while Maurer has said measures to restrict COVID-19's spread are costing the country around 5 billion francs per week in lost output. Switzerland has begun a gradual re-opening.

"The new debt of 30 to 50 billion Swiss francs in this one year is so large that we will not be able to reduce it again so quickly," Maurer told the paper. "Otherwise we would have to make extreme cutbacks in the budgets for the coming years."

He also said he did not expect an OECD plan to harmonise taxation of the digital economy to wrap up by mid-year, as planned.

"We assume the plans get adjusted again, especially with the call for a minimum tax, but nothing has been officially decided yet," Maurer told the paper.