By Michael S. Derby

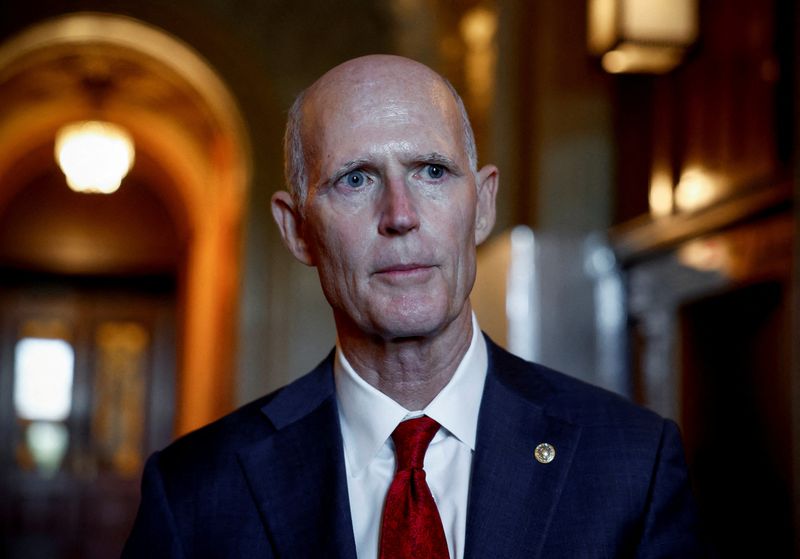

(Reuters) - U.S. Senator Rick Scott, a fierce critic of the Federal Reserve's bond-buying program, has sent a new letter to central bank Chair Jerome Powell complaining about what the Florida Republican sees as slow progress in shedding assets from its balance sheet.

Scott's letter to Powell, sent Monday, followed a barrage of letters he sent recently to the newest Fed board members - Fed Vice Chair Philip Jefferson and governors Lisa Cook and Adriana Kugler - seeking their positions on the Fed's ongoing balance sheet reduction program.

To Powell, Scott asked why a process that has seen the Fed shed about a trillion dollars in bonds has moved more slowly than central bankers had expected.

“It is clear that your current plan to reduce the balance sheet is insufficient, and that it would never solve the problem of your massive balance sheet,” Scott wrote. “It makes no sense to me why you cannot reduce the balance sheet at the same rate you have increased it.”

Scott also asked if the Fed would move to a more “proactive” stance of balance sheet reduction.

The Fed is allowing nearly $100 billion in Treasury and mortgage bonds to mature each month without being replaced. It has not actively sold any securities, although some central bankers have weighed selling mortgage bonds at some point.

The Fed, which has long faced criticism that its asset purchases may warp financial markets, more than doubled the size of its balance sheet between the spring of 2020 and the summer of 2022, when holdings peaked just shy of $9 trillion.

In an interview, Scott said he had not received any response to his letters. A Fed spokesperson said the central bank plans a response.

Scott asked Powell for similar information in January. A spokesperson from Scott's office said Scott had not received a written response but had discussed balance sheet issues during in-person meetings with central bankers over the last several years.

Scott also pressed in his most recent letters to see whether the Fed officials support a bill he has co-sponsored with Elizabeth Warren, a Massachusetts Democrat, to make the Fed's Inspector General a presidentially appointed post requiring Senate confirmation.

The IG is currently appointed by the Fed chair, an arrangement Scott, Warren and some outside experts have said presents a conflict of interest. The legislation, however, has made little apparent progress.