A look at the day ahead in European and global markets from Anshuman Daga

After a tumultuous quarter that saw global inflation and borrowing costs skyrocket and hammer risky assets, the first trading day of the fourth quarter is probably just what investors needed - a quiet session.

Asian equities were mixed in early trade in a holiday-heavy week, with the spotlight clearly on energy costs after oil prices jumped more than 3% on news OPEC+ was considering an output cut of more than 1 million barrels a day.

This would mark the biggest cut since the pandemic began and comes in the wake of a beating for oil prices on worries about global economic growth and a rally in the U.S. dollar.

However, there was no stopping the flow of bearish news for Britain, which is battling a self-inflicted crisis.

Standard & Poor's cut the outlook for its AA credit rating on British sovereign debt to "negative" from "stable" after the country announced massive tax cut proposals.

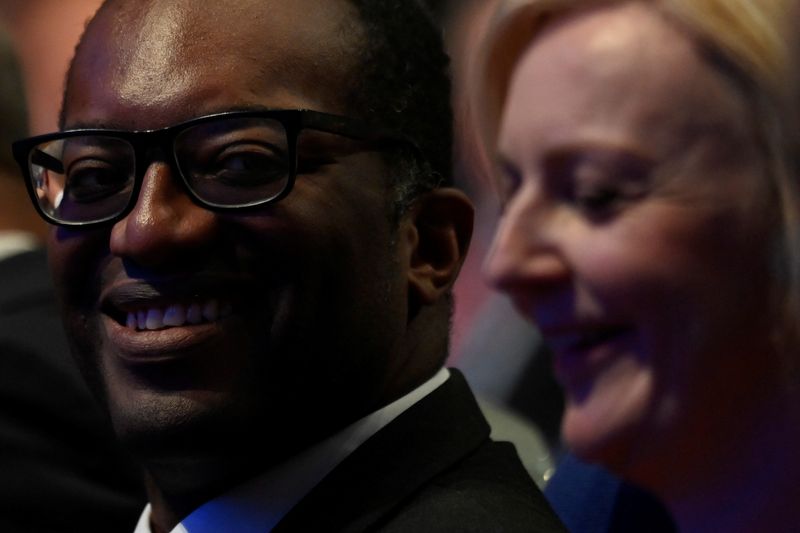

And days after the country's borrowing costs surged the most in decades and the pound plunged to a record low, Prime Minister Liz Truss defended her economic plan, though admitted that she should have done more to "lay the ground" for it.

Manufacturing activity data, due on Monday, will provide investors with clues on how global growth is shaping up.

Sterling weakened on Monday but remained off its record low of $1.0327.

Despite the weakness in stocks, equity strategists at Standard Chartered (OTC:SCBFF) Wealth Management said the UK was one of its preferred regions, with fiscal stimulus expected to be positive for growth and the currency weakness set to support companies with significant overseas revenue.

"Valuation is at its deepest discount compared with the last 20 years, and inexpensive on an absolute basis. Its equities offer a good balance between income and growth, offering relative dividend yield 2% higher than global equities," the strategists said.

Meanwhile, Brazil's presidential election was headed for a run-off vote after President Jair Bolsonaro's surprising strength in the first round spoiled rival Luiz Inacio Lula da Silva's hopes of winning outright.

Graphics: Sterling volatility: https://fingfx.thomsonreuters.com/gfx/mkt/akvezdarjpr/Two.PNG

Key developments that could influence markets on Monday:

UK Chancellor Kwasi Kwarteng speaks at Conservative Party conference

Bank of England's Catherine Mann speaks

Swiss Sep inflation

U.S., euro zone, UK, Canada and other PMIs (September)

Fed's Thomas Barkin, Raphael Bostic and Esther George all speak at events