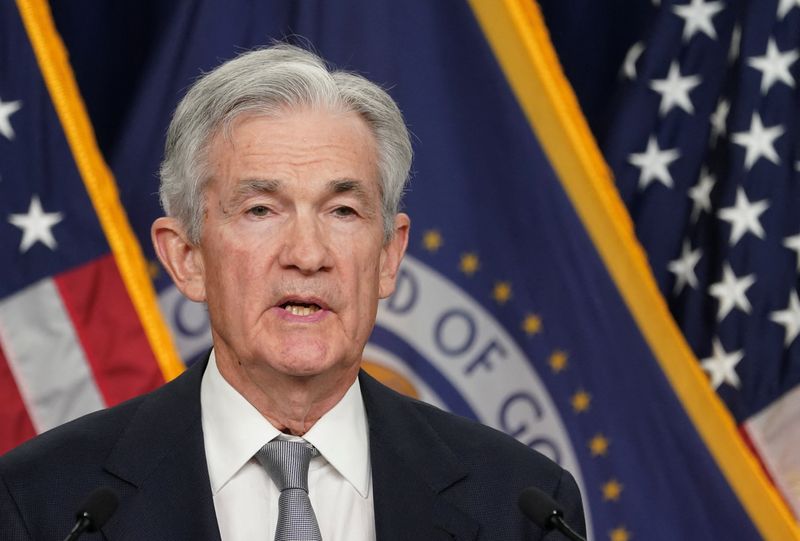

Investing.com -- Next week's inflation data may provide Federal Reserve's chairman Jerome Powell with the opportunity to tee up a September rate cut, Jefferies said, following a slew of recent economic data including Friday's labor market that has kicked the Fed's 'good news' counter into gear.

"If the CPI data next week comes in on the cooler side once again (which is our expectation), then the Fed may move to signal a rate cut as soon as the September meeting," Jefferies said in a Friday note, ahead of Thursday's consumer price index report for June.

Economists expect headline CPI to have risen 0.2% in June from a pace of 0% a month earlier, while core CPI, a more closely watched measure, which strips out food and energy prices, is expected to remain unchanged at 0.2%. The softer CPI would mark the second month of slowing inflation and add further confidence that upside surprises seen in Q1 were a mere aberration from the deflationary trend seen last year.

Bets on a September rate cut received a major boost in the wake of Friday's job report showing that April and May's job gains were revised lower, overshadowing the better-than-expected payroll gains in June and pointing to signs of slowing in the labor market. As well as the downward payroll revisions, an unexpected uptick in the unemployment rate in June to 4.1% and slowing average hour wages slowed added further credence to expectations for the job the market to slow.

The nonfarm payroll data supported Fed chairman Powell's remarks earlier this week that the U.S. labor markets have seen “a pretty substantial move toward better balance than we had a couple of years ago.” Both the jobless rate and wage levels are approaching a more “sustainable” level, he added.

Traders now see a 70% of a rate cut in September, down from 60% in the prior week, according to Investing.com's Fed Rate Monitor Tool.

Economic data since April has helped the Fed's "good news" counter tick higher, just ahead of Powell's testimony before Congress and July Fed meeting -- two events that could provide the Fed chief with the opportunity to lay out the carpet for September rate cut.

Fed officials have recently signaled that more confidence is needed before dropping the axe on rates, but "their tune could change at the next meeting on July 31, or perhaps as soon as Powell's testimony before Congress next week," Jefferies added.

Powell begins two days of testimony before Congress on Tuesday.