A look at the day ahead in European and global markets from Ankur Banerjee

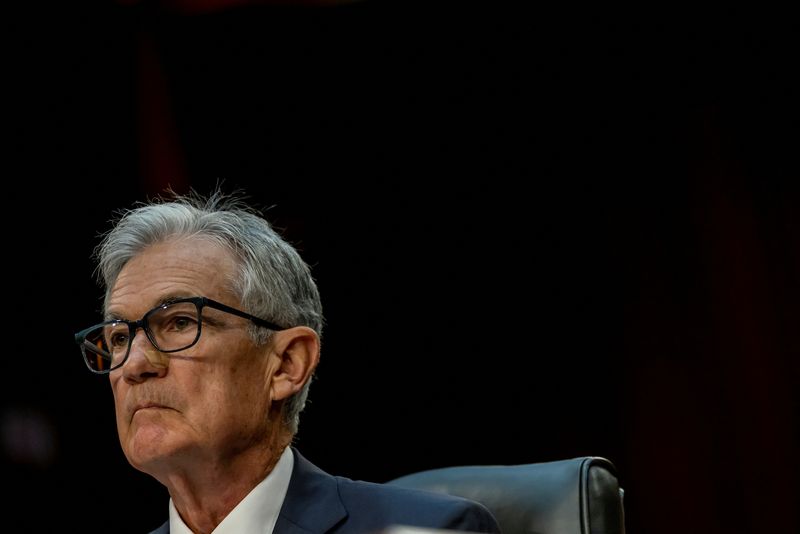

Fed Chair Jerome Powell's sort of dovish comments have cemented an interest rate cut in September, at least in markets' eyes, with the prospect of Donald Trump making a return to White House keeping trades associated with it in play and on investor minds.

In what could be his last public comments before the U.S. Federal Reserve goes into a blackout ahead of its July 30-31 policy meeting, Powell remained cautious but suggested that recent inflation data have been in the right direction for the inflation rate to return to the Fed's target of 2%.

"We've had three better readings, and if you average them, that's a pretty good place," he said at an event on Monday.

The comments were enough for markets to once again shift rate expectations, with traders anticipating 68 basis points of easing this year. A rate cut in September is now fully priced in, the CME FedWatch tool showed.

That has left the U.S. dollar swaying, with the greenback weakening in the wake of Powell's comments but seeing a bit of strength in Asian hours as investors ponder what a Trump presidency could mean for inflation and interest rates.

Trump made a triumphant entrance at the first night of the Republican National Convention on Monday, receiving a raucous ovation from the party faithful two days after a would-be assassin's bullet grazed the former U.S. president's right ear.

The attack has bolstered expectations of a Trump victory in the November election, with cryptocurrencies surging, gold stalking a record high and the bond yield curve steepening as investors favour so-called Trump-victory trades.

In Europe, futures indicate bourses are due for a subdued start on Tuesday and, with little in the economic calendar for investors to take cues from, Trump and Powell will yet again dictate market movement.

Focus will be given to luxury stocks in the wake of Burberry on Monday flagging a possible loss and scrapping its dividend. A gauge of the top 10 European luxury stocks lost 3% on Monday, its biggest one-day percentage decline in 10 months.

Key developments that could influence markets on Tuesday: * Economic events: euro zone trade balance for May, U.S.retail sales * Earnings: U.S. earnings season is underway: BofA, MorganStanley and UnitedHealth (NYSE:UNH)

(By Ankur Banerjee; Editing by Christopher Cushing)