A look at the day ahead in European and global markets from Wayne Cole.

Yen intervention, UK politics, China data dump

While tight lipped, Japanese policy makers clearly intervened again to support the yen on Monday, slamming the dollar down to as low as 145.28 from an early peak of 149.70.

Yet all the BOJ seems to have managed is to give yen bears better levels, and much-needed liquidity, to sell into and the dollar quickly rallied back to around 149.00.

While the BOJ is only acting under the directions of the MoF, selling dollars for yen sits at odds with its dogged commitment to uber-easy monetary policy and will add to pressure for a change of course at its policy meeting on Friday.

BOJ boss Kuroda has so far shown no sign of reversing course ahead of retirement next year and markets might have to wait for a new face to see the end of YCC.

A, sort of, new face is a step closer to being British PM after Boris Johnson bowed out of the leadership race, leaving former FinMin Rishi Sunak in pole position.

The news initially saw sterling jump almost a cent in Asia to $1.1402, but that could not be sustained and it edged back to around $1.1330.

Investors will worry the political uncertainty is far from over given Sunak is not exactly well loved by right wingers in the Tory party and fresh divisions could erupt at any time.

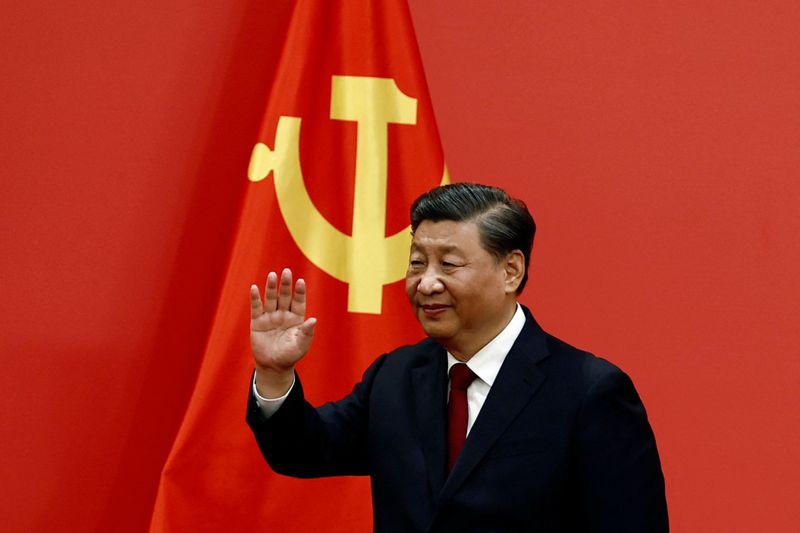

Beijing marked the rubber-stamping of Xi for a third term as leader by dumping a week of delayed data on markets, and a mixed bunch it was. Topping forecasts were GDP and industrial output, but retail sales disappointed and house prices kept falling in a warning sign for the stretched property sector.

Xi's choice of loyalists for top policy positions did not seem to cheers investors and blue chips fell over 1%, while the PBOC fixed the yuan lower - one way of stimulating the economy.

Key developments that could provide more direction to markets on Monday:

Race for UK PM could be essentially decided if no one but Sunak gets support of 100 MPs

U.S., European PMIs (October)