By Leika Kihara

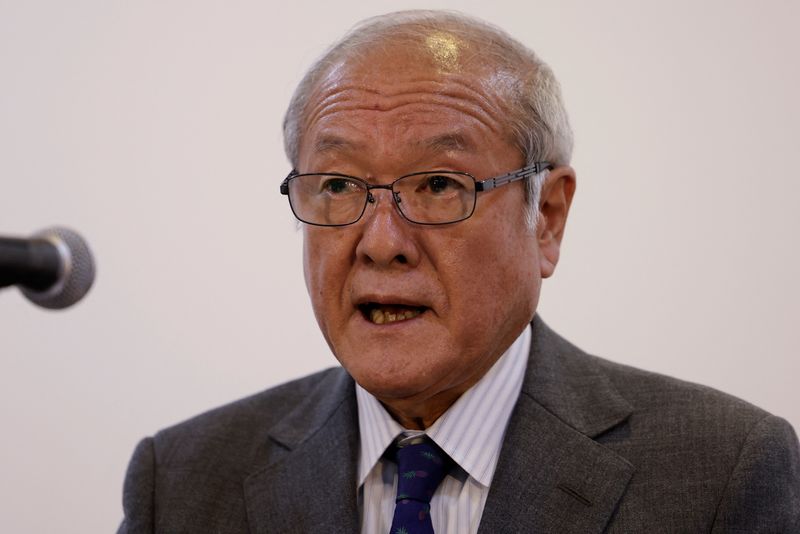

MARRAKECH, Morocco (Reuters) - Japanese Finance Minister Shunichi Suzuki said on Friday he told his G20 counterparts that Tokyo may need to take "appropriate action" in the exchange-rate market as global monetary tightening could heighten volatility in currency moves.

The remarks came as the yen renewed its declines against the dollar, and underscored Tokyo's resolve to keep markets on edge over the chance of exchange-rate intervention to prop up the Japanese currency.

"I told the G20 meeting we need to be mindful of the risk that market volatility could heighten, including in the currency market, as monetary tightening continues globally," Suzuki told a news conference after attending a meeting of Group of 20 (G20) finance ministers and central bank governors.

"I also said excess volatility in the currency market was undesirable, and that we may need to take appropriate action depending on developments," Suzuki said.

The dollar rose broadly on recent strong U.S. inflation data, on expectations the U.S. Federal Reserve will keep rates higher for longer.

The dollar fetched 149.53 yen on Friday, not far from the 150 mark seen by traders as Tokyo's line-in-the-sand for currency intervention.

A senior Japanese ministry of finance official told reporters that while Suzuki's latest comments stated the obvious, the fact they were made at the G20 floor in times of heightening market volatility was meaningful.

The official said Tokyo stood ready to act in the currency market if market moves become too volatile.

A weak yen boosts Japanese exports, but also pushes up the cost of importing fuel and raw materials, giving Tokyo policy makers a headache. Japan last intervened in the currency market to prop up the yen in September and October last year.

Bank of Japan Governor Kazuo Ueda told the same news conference that his views on the global economic outlook have not changed much, after attending the Group of Seven (G7) and G20 finance leaders' gathering this week.

The outlook for the global economy is among factors the BOJ will scrutinize in determining the timing for phasing out its massive stimulus program, analysts said.

Markets are focusing on the BOJ's new quarterly growth and inflation forecasts, set for release at its next two-day policy meeting that concludes on Oct. 31.

The G7 and G20 meetings were held on the sidelines of the annual International Monetary Fund and World Bank meeting in Marrakech this week.