By Leika Kihara

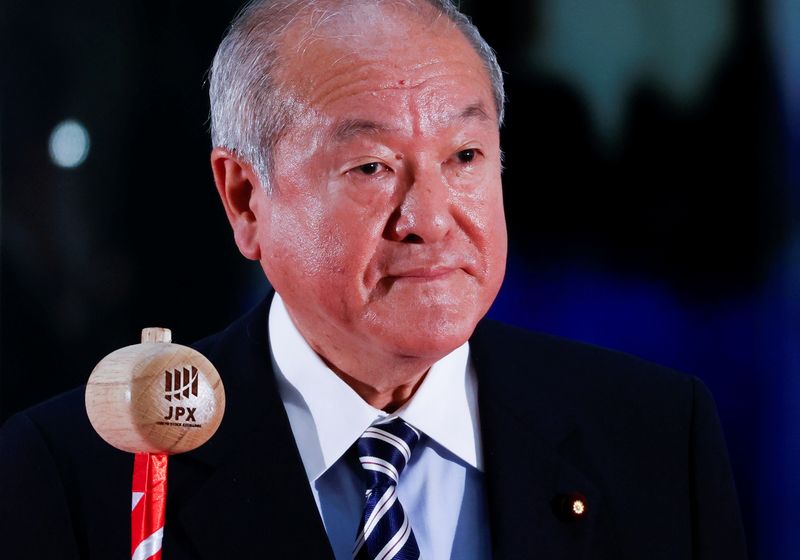

TOKYO (Reuters) -Japan must respond to any damage inflicted on the economy by recent rising prices, Finance Minister Shunichi Suzuki said on Wednesday, a sign that the hit to households from the cost of living is emerging as a fresh headache for policymakers.

Suzuki said the recent rise in prices was driven mostly by higher global fuel costs, rather than any increase in import prices from a weak yen.

"If prices rise before wages ... that could hurt household income and affect consumption," Suzuki told parliament. "We must respond to any impact such price moves could have on the economy," he added.

Suzuki did not elaborate on what steps the government could take.

His comments came in response to a question from an opposition lawmaker on whether the Bank of Japan's ultra-loose policy, and a resulting weak yen, were to blame for pushing up household living costs.

Japan's consumer inflation remains stuck around 0.5%, well below Western nations and the BOJ's 2% target. With wages barely rising, however, the hit to households is becoming a politically hot topic ahead of an upper house election likely around July.

The country relies almost entirely on imports for fuel, making its economy vulnerable to oil price swings. The government launched a temporary subsidy programme last month to ease the blow from rising fuel prices on households, and has signalled the possibility of taking further measures.

While the economy rebounded in the final three months of 2021, some analysts expect a contraction in the current quarter as a spike in COVID-19 cases and rising prices hit consumption.

BOJ Governor Haruhiko Kuroda has repeatedly said a weak yen was beneficial for the economy as a whole, and brushed aside the chance of a near-term exit from ultra-loose policy.