By Tetsushi Kajimoto

TOKYO (Reuters) -Japanese Finance Minister Shunichi Suzuki said on Tuesday the United States showed understanding to "a certain extent" on Tokyo's currency market intervention last month, giving Japan's first public indication of U.S. backing for the move.

Japanese authorities sold dollars and bought yen in a market intervention for the first time in 24 years, spending 2.8 trillion yen ($19.21 billion) to slow a rapid slide in the yen that it considered a threat to the economy.

While Japanese officials have said they do not necessarily need U.S. consent for action in the currency markets, they repeatedly stress the importance of seeking U.S. understanding, which is seen as lending them legitimacy.

At meetings of the G7 and G20 nations, Suzuki said, he has explained Japan's concern about the potential damage from sharp dollar/yen moves and reaffirmed past G7 agreements on the exchange market.

"I've been continuing to make such efforts and we have gained a certain extent of understanding from the U.S. authorities towards our latest intervention," he told reporters.

"Our stance remains unchanged that we will take appropriate steps in case of excess volatility from now on as well."

Market players had expected Japan might find it difficult to secure U.S. understanding for currency intervention, given Treasury Secretary Janet Yellen's firm belief in market-determined exchange rates and the U.S. commitment to battle inflation via monetary tightening, which has fuelled the dollar's rise.

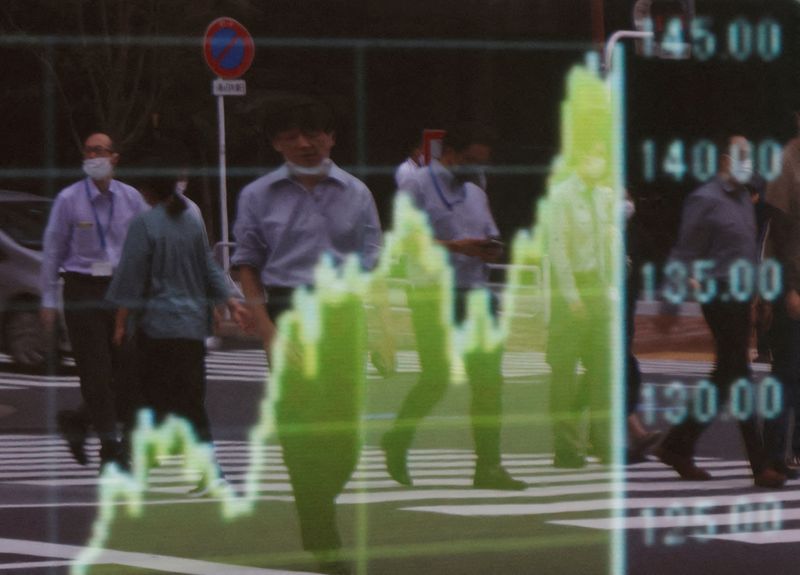

While Japan's intervention briefly halted the dollar's relentless rise against the yen, the U.S. currency has since resumed its climb and was hovering around 145.75 yen in Tuesday afternoon trade in Asia, just below a 24-year high of 145.90 that preceded the Sept. 22 intervention.

"It's true the current market is reflecting the dollar's solo strength," Suzuki said, adding that he was carefully watching currency market moves with a "strong sense of urgency".

Suzuki, who took office a year ago, said he would explain Japan's recent intervention to financial leaders from the Group of 20 major economies when they gather this week in Washington, where he expected discussions within the context of how monetary tightening could affect the global economy.

Japan's top currency diplomat, Masato Kanda, also weighed in on Tuesday on the topic of potential currency intervention, saying that authorities were always ready to take necessary steps against excess currency volatility, according to broadcaster TBS.

Kanda was quoted as telling reporters that he could make a decision on currency intervention anywhere, including from an airplane.

($1 = 145.7400 yen)