By Tetsushi Kajimoto and Leika Kihara

TOKYO (Reuters) -Japanese policymakers maintained their warning to investors against selling the yen on Thursday in the wake of the currency's renewed slide beyond 150 to the dollar, a level seen by traders as authorities' threshold for intervention.

"It's important for currency rates to move stably reflecting fundamentals. Excess volatility is undesirable," Deputy Chief Cabinet Secretary Hideki Murai told a regular news conference, when asked about the yen's declines. He declined to comment on whether Japan will intervene in the currency market.

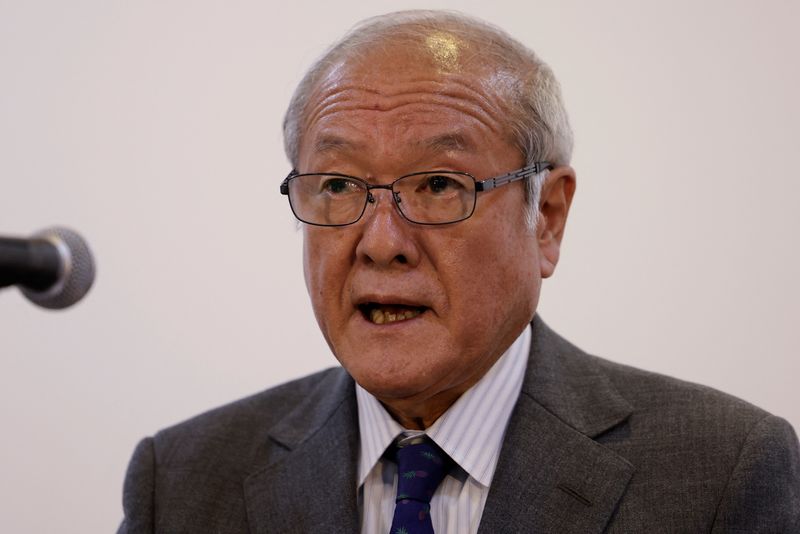

Finance Minister Shunichi Suzuki also told reporters earlier on Thursday that authorities were watching markets "with a sense of urgency," but did not make any comment about intervention.

The Japanese yen weakened to a fresh one-year low of 150.50 per dollar on Thursday and was not far off the 151.94 it touched in October last year, which prompted Japan to intervene in the currency market.

While a weak yen boosts exporters' profits, it has recently become a headache for Japanese policymakers as it inflates the cost of raw material imports and households' cost of living.

The comments on Thursday used softer language than those typically used ahead of intervention.

Authorities tend to escalate their warnings when currency intervention is imminent, saying they stand ready to take "decisive action" and that they won't rule out any options.

The yen's falls, driven by the gap between U.S. and Japanese interest rates, will likely keep pressure on the Bank of Japan to tweak its policy of capping long-term yields around zero.

Sources have told Reuters a hike to an existing yield cap set just three months ago is being discussed as a possibility in the run-up to next week's policy meeting.

Rising global yields and expectations of a near-term BOJ policy shift pushed up the benchmark 10-year Japanese government bond (JGB) yield to 0.885% on Thursday, hitting its highest since July 2013 and approaching the bank's 1.0% cap.

Japan's core inflation hit 2.8% in September, exceeding the BOJ's 2% target for the 18th straight month, heightening expectations the central bank will soon end negative short-term rates and its yield curve control (YCC) policy.

BOJ Governor Kazuo Ueda has stressed the need to keep monetary policy ultra-loose until the current cost-driven price rises shift to a more durable, demand-driven inflation.

With wages failing to rise enough to beat inflation, the government plans to compile a package of measures to cushion the blow to households from rising living costs that could include around $33 billion for payouts and income tax cuts.