By Leika Kihara

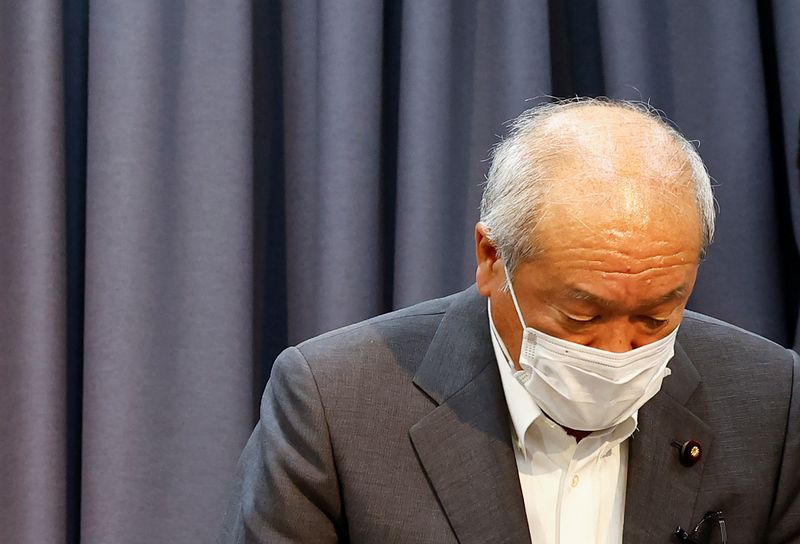

WASHINGTON (Reuters) - Japan is ready to take "decisive" action against rapid yen declines and is focusing on volatility rather than levels in deciding whether to intervene again, Finance Minister Shunichi Suzuki said.

Suzuki said he told his G7 and G20 counterparts that Japan was "deeply worried about sharply rising volatility" in the currency market.

"We cannot tolerate excessive volatility in the currency market driven by speculative moves. We're watching currency moves with a strong sense of urgency," Suzuki told reporters on Wednesday after attending the G7 finance leaders' meeting in Washington.

"It's not as if we have a specific (dollar/yen) level in mind. Instead, we're looking at volatility."

Japan intervened in the currency market last month to arrest sharp yen falls, driven largely by the policy divergence between aggressive U.S. interest rate hikes and the Bank of Japan's resolve to keep monetary policy ultra-loose.

Markets are focusing on whether Japan will step into the currency market again to prop up the yen, following Tokyo's yen-buying intervention last month.

The dollar was trading near 147 yen, edging closer to a high of 147.64 recorded in August 1998. Japanese authorities intervened to prop up the yen when it touched 145.90 per dollar.

Government spokesperson Hirokazu Matsuno earlier told reporters in Tokyo that Japan was ready to take appropriate steps against excess volatility in foreign exchange markets.

Suzuki said it was necessary to look at the global spill-over effects of advanced nations' monetary tightening aimed at curbing inflation.

The finance minister and BOJ Governor Haruhiko Kuroda are visiting Washington to attend the International Monetary Fund (IMF) meetings and the G7 and G20 finance leaders' gathering held on the sidelines.