By Tetsushi Kajimoto

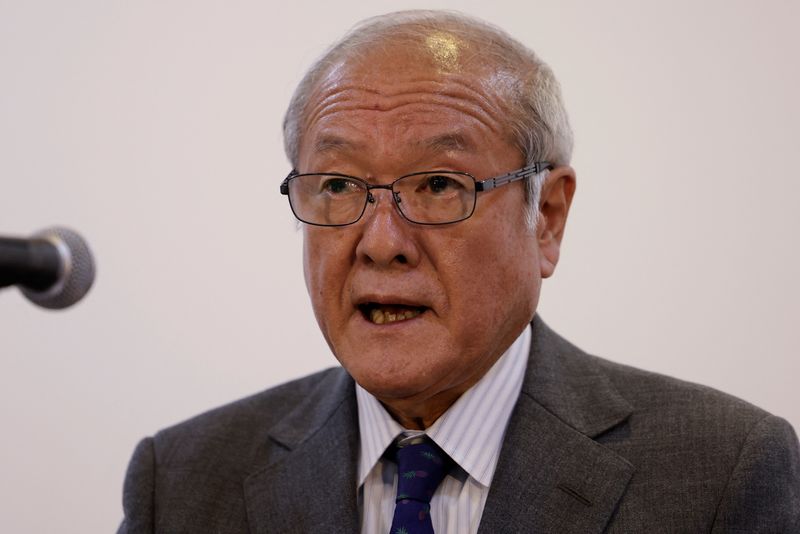

TOKYO (Reuters) -Japanese Finance Minister Shunichi Suzuki on Tuesday declined to comment on remarks by an International Monetary Fund (IMF) official about currency intervention, and said there was no need to elaborate on what factors would determine exchange rates.

The yen's recent declines are driven by fundamentals and do not meet any of the considerations that would call for authorities to intervene in the currency market, Sanjaya Panth, deputy director of the IMF's Asia and Pacific Department said last week.

"I'm aware the comment was made by one official of the IMF. Various people make remarks so there's no need for me to comment on every single remark," Suzuki told reporters.

Masato Kanda, vice finance minister for international affairs at Japan's Ministry of Finance, said on Monday various factors determine currency rates and long-term interest rates are "only one factor".

The IMF sees foreign exchange intervention as justified only when there is a severe dysfunction in the market, a heightening of financial stability risks or a de-anchoring of inflation expectations. However, none of these three considerations exist right now, Panth said.

Japan bought yen in September and October last year, its first foray in the market to boost the currency since 1998, to stem sharp declines that eventually pushed the yen to a 32-year low of 151.94 to the dollar.

The yen has hovered just below the 150 per dollar danger line that some investors bet may trigger intervention, although Japanese authorities maintain that it is not a level but the speed of fluctuations that would matter for intervention.

Authorities in Japan are facing renewed pressure to combat a sustained depreciation in the yen, as investors bet on higher-for-longer U.S. interest rates while the Bank of Japan remains wedded to its super-low interest rate policy.