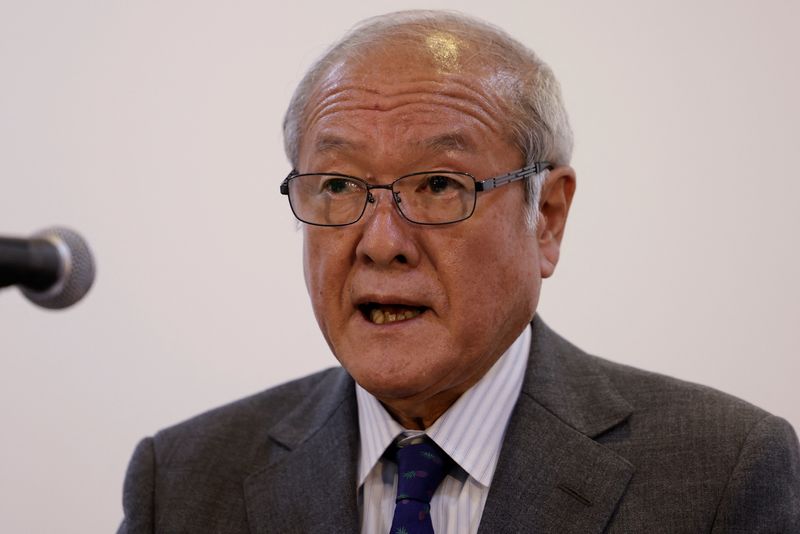

TOKYO (Reuters) -Japanese Finance Minister Shunichi Suzuki said on Tuesday he was concerned about the negative implications of the current weakness in the yen and its effect on incentives to increase wages.

"One of our major goals is to achieve wage increases that exceed the rise in prices," Suzuki said. "On the other hand, if prices continue to remain high, it will be difficult to reach this target even if wages rise."

While a weak yen is a boon to exporters, it has become a headache for Japanese policymakers as it hurts consumption by pushing up the cost of raw material imports.

The yen's slump past 160-per-dollar late last month triggered a suspected round of interventions by Tokyo.

The Japanese currency has bounced since then and was last fetching around 156.45.

In a regular post-cabinet meeting press conference, Suzuki reiterated that the foreign exchange rates should be set by markets reflecting fundamentals and that it was desirable for the currency to move in a stable manner.

The government will monitor the currency market closely and take appropriate action as necessary, he said.

Responding to questions about benchmark Japan government bond yields hitting the highest in more than a decade on Monday, Suzuki said it is important for the government to closely monitor the market and communicate with traders.

The 10-year JGB yield traded around 0.979% in morning deals.

"The government would implement appropriate debt management policies to ensure the stable issuance of government bonds," Suzuki said.