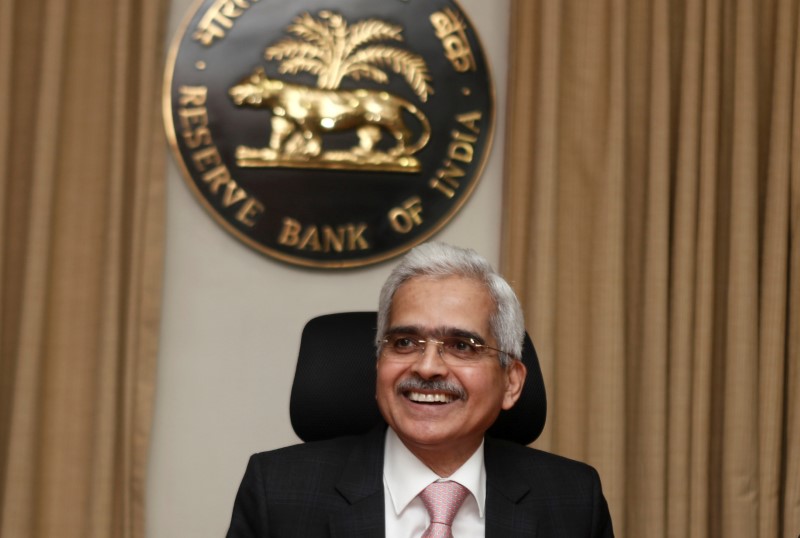

MUMBAI (Reuters) - Monetary policy has its limits and the Indian government will have to use fiscal measures and structural reforms to revive demand and support the sagging economy, Reserve Bank of India governor Shaktikanta Das said in a speech on Friday.

The economy is projected to grow 5% in the fiscal year due to end in March, its lowest growth rate in 11 years.

Das said the RBI had used the space that was opened up by the moderation in inflation early last year and started loosening monetary policy after having recognized the imminent slowdown in growth even before it was confirmed by data.

"Monetary policy, however, has its own limits," he said.

"Structural reforms and fiscal measures may have to be continued and further activated to provide a durable push to demand and boost growth".

Das was speaking at a college event in New Delhi ahead of the federal budget that is due to be presented on Feb. 1.

He said potential drivers of growth like prioritizing food processing industries, tourism, e-commerce, start-ups and efforts to become a part of the global value chain could give a significant push to the economy.

"The government is also focusing on infrastructure spending which will augment growth potential of the economy. States should also play an important role by enhancing capital expenditure which has high multiplier effect," Das added.

Finance Minister Nirmala Sitharaman, who will announce the budget, is widely expected to include stimulus measures for small businesses and non-banking finance companies as a cut in corporate tax rates and rate cuts by the central bank have failed to revive growth.

The central bank, which has cut interest rates by a combined 135 basis points in five moves since February last year, kept rates on hold at its last review in December. It is expected to maintain sit tight on Feb. 6 as well.