By Swati Bhat and Sudipto Ganguly

MUMBAI (Reuters) - The Reserve Bank of India's monetary policy committee may lean more on data in deciding the key interest rate going ahead even as policymakers appeared divided on the future path of rate hikes, minutes of its September meeting suggested on Friday.

The MPC raised its benchmark repo rate by 50 basis points late last month, the fourth straight increase to tame stubbornly high inflation.

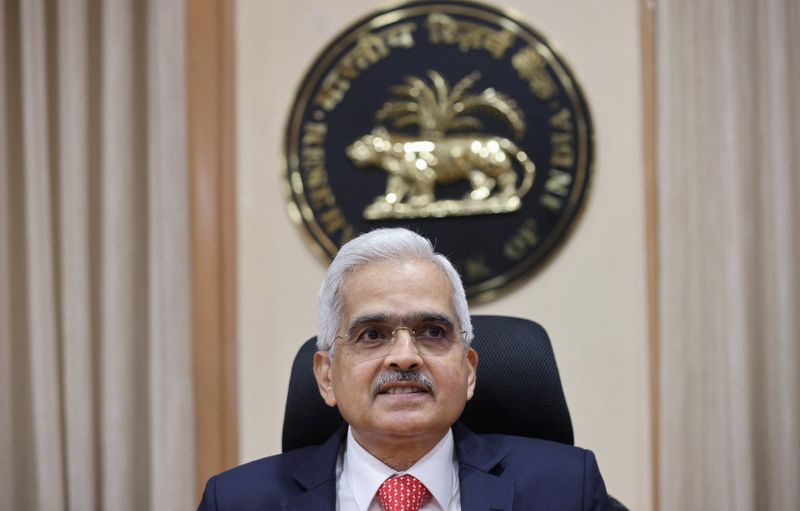

"Going forward, monetary policy needs to remain watchful and nimble, based on incoming data and evolving conditions," RBI Governor Shaktikanta Das wrote in the minutes.

Minutes from two external members Ashima Goyal and Jayant Varma, however, showed their preference for a tapering of the rate-hike cycle going ahead.

"A pause is needed after this hike because monetary policy acts with lags," Varma wrote in his minutes.

"It is dangerous to push the policy rate well above the neutral rate in an environment where the growth outlook is very fragile," he added.

RBI's forecasts and the survey of professional forecasters show inflation falling to around 5 percent in the first quarter of the next financial year, Varma wrote.

India's annual retail inflation accelerated to a five-month high of 7.41% in September, its ninth straight reading above the MPC's target band of 2-6%, but wholesale price inflation fell to an 18-month low, separate data this week showed.

Michael Patra, deputy governor in-charge of monetary policy, underlined the importance of front-loading rate hikes.

"Front-loading of monetary policy actions can keep inflation expectations firmly anchored and balance demand against supply so that core inflation pressures ease," Patra wrote.

"It will also reduce the medium-term growth sacrifice associated with steering inflation back to target."

Patra said even after stripping inflation off the recent transitory supply side shocks, price rise has become unyielding and tightly range bound around the upper tolerance band of the inflation target.

"The need of the hour is calibrated monetary policy action, with a clear understanding that it is required for sustaining our medium-term growth prospects," Das said.

Varma highlighted the need for monetary policy to focus on domestic economic factors, saying, "MPC cannot be guided by the effect of global monetary tightening on the interest rate differential".

Goyal said the carry trade based on interest rate differentials "is not a stable source of financing".

"India has earned enough independence to protect itself from policy errors of other nations," she added.