By Jonathan Saul

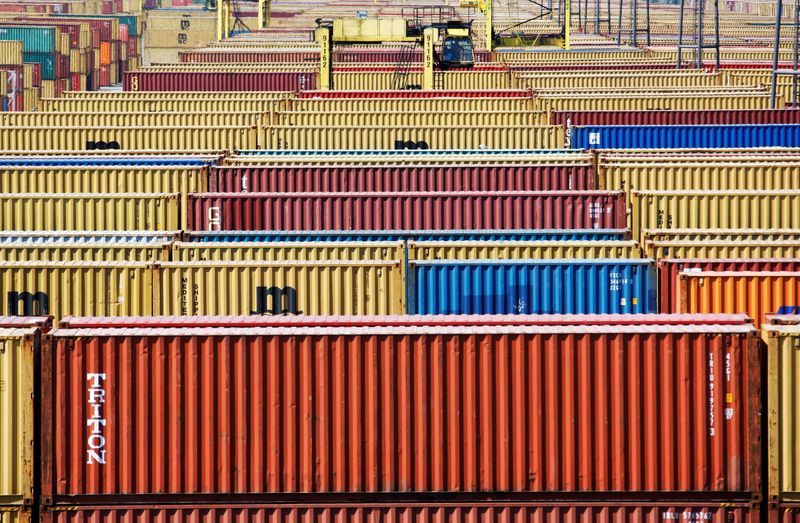

LONDON (Reuters) - Efforts to speed up the movement of goods around the world have yet to solve the supply chain bottlenecks caused by surging demand for retail goods and pandemic-related lockdowns, the latest shipping data shows.

Delays at U.S. major ports have been particularly severe, but knock-on effects have also been felt around the world.

This week's Lunar New Year holiday in China and across Asia is also expected to aggravate delays.

The journey time from China's northern Dalian port to the major European port of Antwerp rose to 88 days in January from 68 days in December because of a combination of congestion and waiting time. This compared with 65 days in January 2021, analysis from logistics platform project44 showed.

Transit time from Dalian to the eastern British port of Felixstowe, which has seen some of the biggest backlogs in Europe, reached 85 days in January from 81 in December, versus 65 days in January 2020.

A survey conducted in January by technology company Container xChange, which canvassed 500 freight industry respondents, found 66% of those polled expected Chinese New Year factory closures to further disrupt container shipping supply chains.

Josh Brazil of project44 said it would take "several years to return to pre-pandemic supply chain stability".

He said new vessel build capacity would not come to the market until 2024, meaning there was "no quick fix".

"While Europe has experienced much less port congestion compared to major U.S. ports, the congestion in southern California causes schedule disruptions and capacity constraints that have global consequences," Brazil said.

Delays at ports along the U.S. West Coast have also increased, with Oakland at over 10 days in January from around five in December, according to project44 data. Delays at Los Angeles stayed around six days in December and January.

Ports have tried to extend working times to clear backlogs and companies have sought to shorten delivery routes and diversify goods suppliers to alleviate delays.

Leading container group A.P. Moller-Maersk told its customers last month it was struggling to move goods around the world.